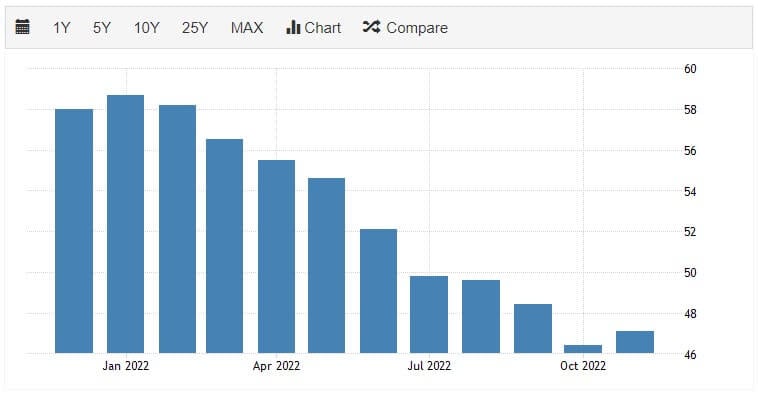

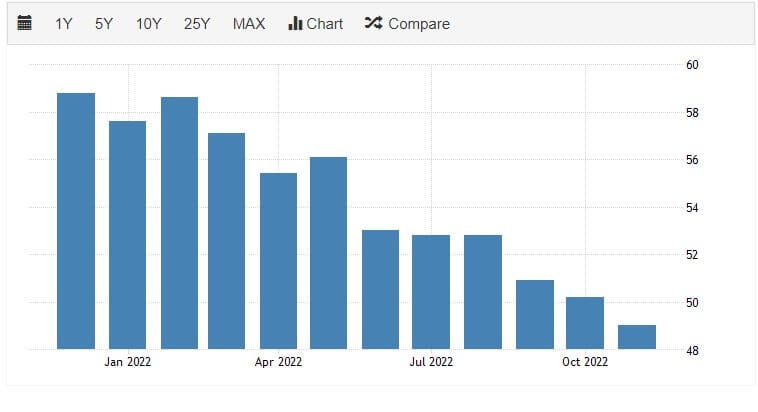

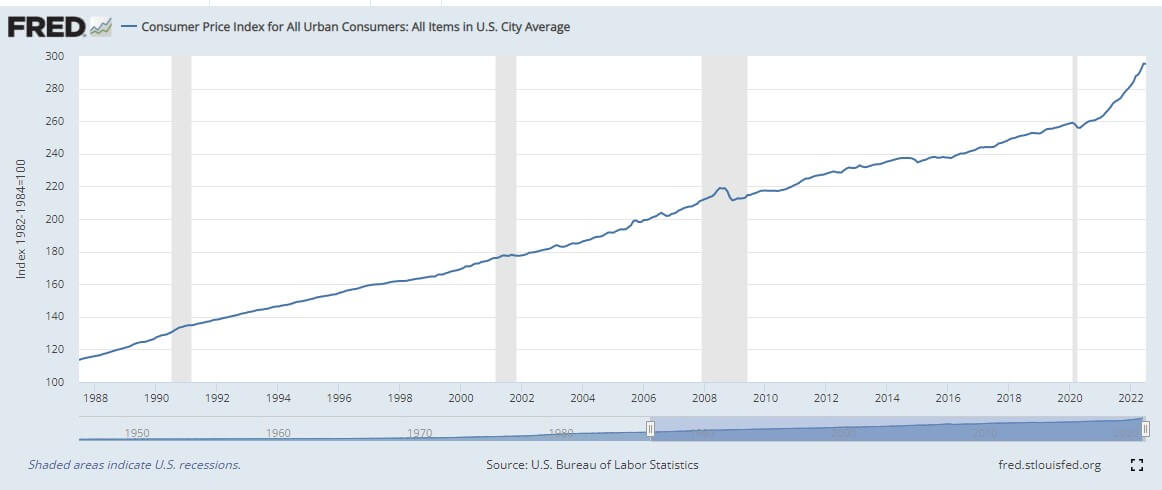

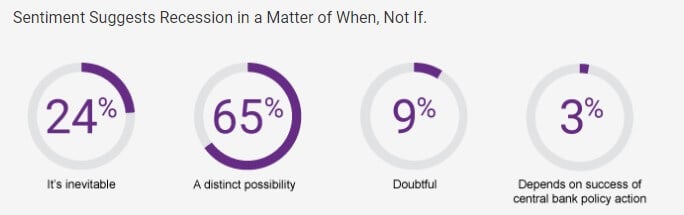

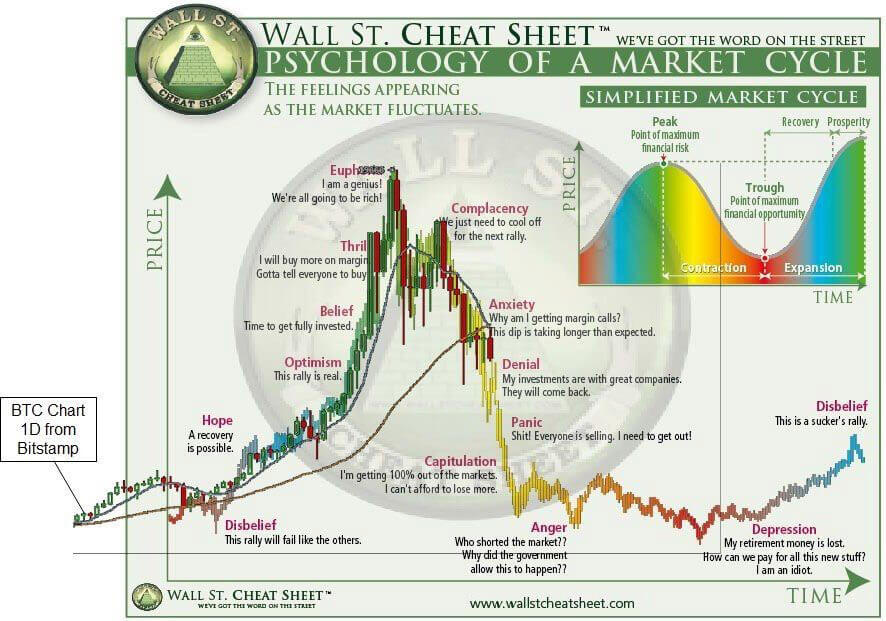

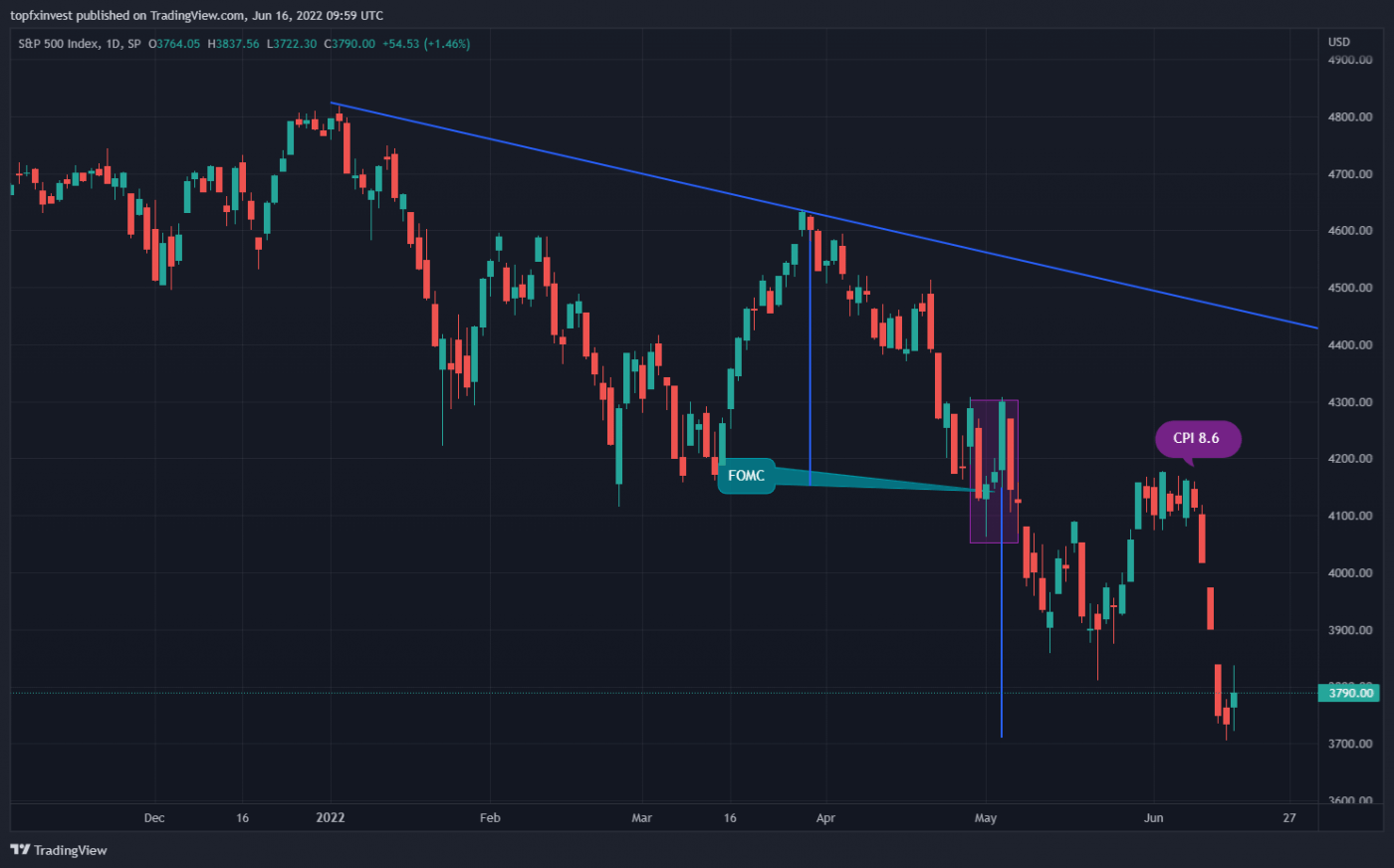

Global growth fears are growing immensely this week and recession fears are at top levels, it seems that bust is coming shortly. According to our last market view, an economic hurricane is coming, and the last week economic outlook is worsening.

Just read some title news from Reuters:

“U.S. retailers tumble after Walmart cuts profit forecast … Walmart cut its forecast for full-year profit, saying it expects its adjusted earnings per share to drop as much as 13%”

“Logitech's quarterly profit slumps 38% as pandemic demand wanes … reported a 38% fall in first-quarter adjusted profit and cut its full-year 2023 outlook on Tuesday”

“some tech companies firing workers in an attempt to reduce costs: OneTrust fired 900 employees, Stitch Fix cuts 330 ID.me dismissed 330 according to CBSNews https://www.cbsnews.com/news/tech-companies-layoffs-stock-market-cryptocurrency/”

JP Morgan CEO Jamie Dimon is telling us that an economic hurricane is coming: “Things are doing fine. Everyone thinks the FED can handle this. That hurricane is right out there down the road, coming our way. We just don’t know if it's a minor one or Superstorm Sandy.”

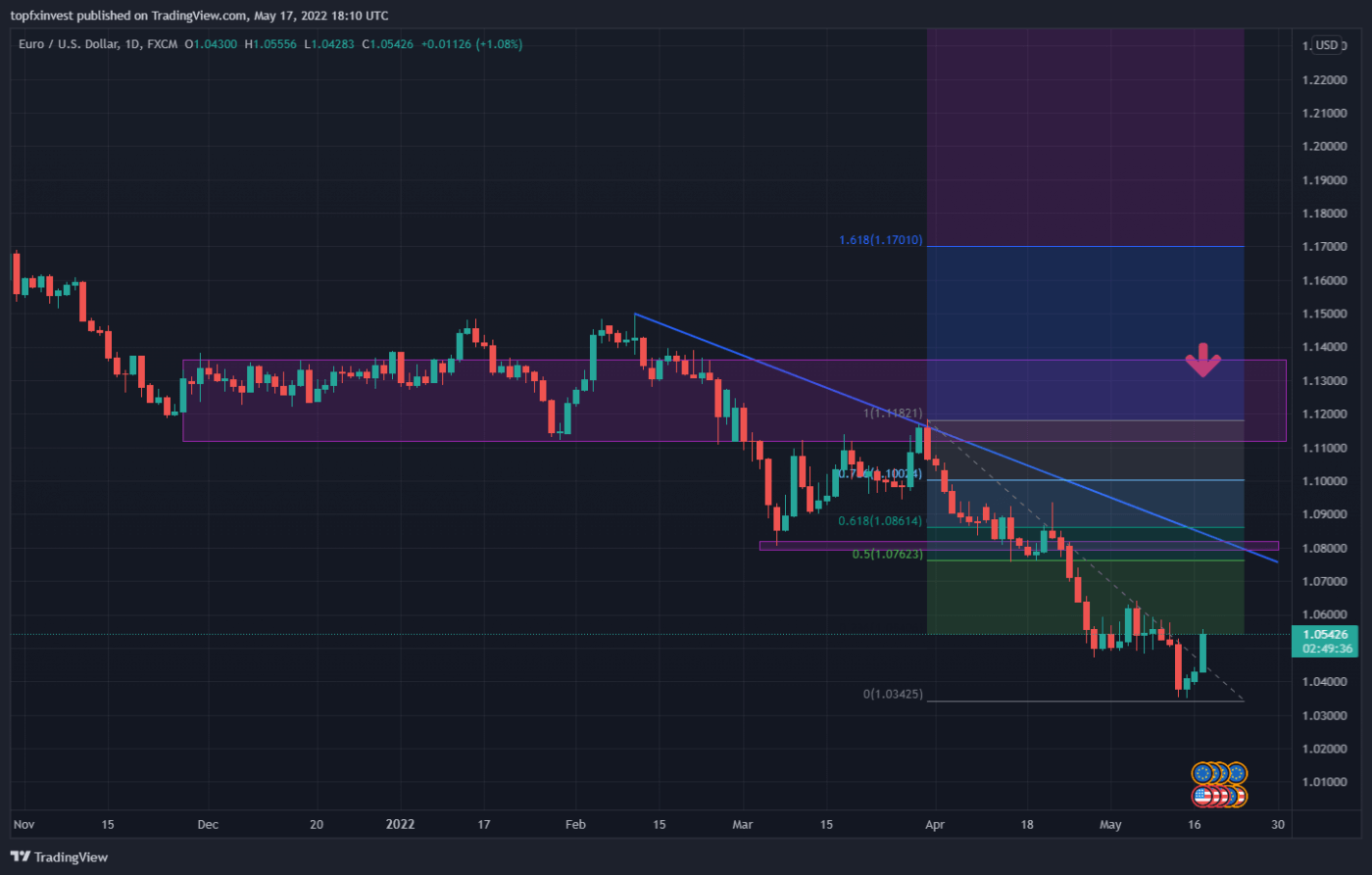

Other macroeconomic vectors are pointing to a recession, below you will find just a couple of them:

- Credit default swaps have nearly doubled so far in 2022

- High yield bond market is pointing to a recession because spread between junk bonds and treasuries surge from 300 to 500 points in 2022

- US consumers Sentiment is pointing down to a level similar to levels of Great Recession

- Atlanta GDP is now pointing to an annualized real GDP growth of just 0% for the second quarter

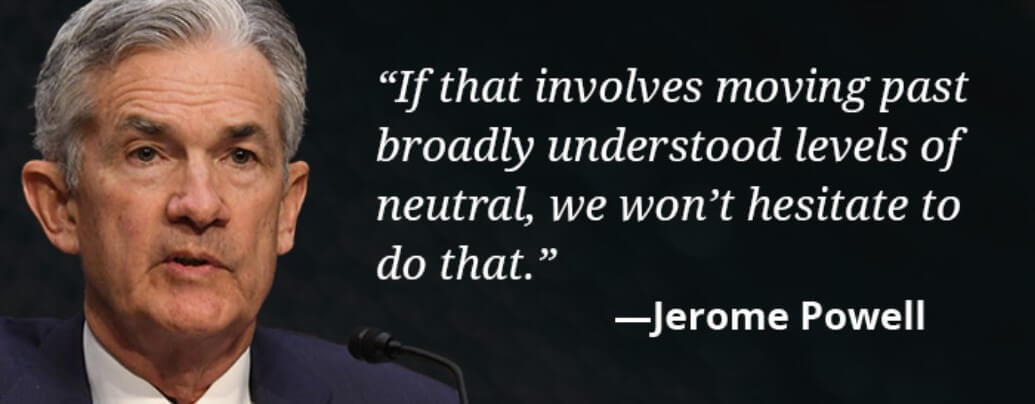

In the past, the increase in the money supply and the low policy interests of FED resulted in a credit boost, while the increased interest rates at the present moment will force many contractors to abandon their projects.

We prefer keeping defensive stocks and, first of all, precious metals. Our portfolio is holding 40% from total assets in Gold & Silver.

Gold will rocket because of factors mentioned above, and 1710 it’s a good price to add to your portfolio.

How to store Gold Best and Safest way?

Because many of our readers asked how to store Gold, I’ll beat the horses on that subject.

The safest way to store Gold is to buy physical Gold and to store it on offshore companies like https://hardassetsalliance.com/. While being safest premium, it’s not too economically because prices are not cheap and it’s suitable for large long-term investor with over 500K. For small investors, the best way to invest in Gold is to buy GOLD ETF in safest jurisdictions like Switzerland and Singapore. Largest Gold ETF have some disadvantages that are not always easy to identify but, for the moment, we will show our requirements on how to choose the best GOLD ETF:

- It must be placed in the safest jurisdiction and in a safe location

- The Gold ETF must be 100% backed by physical Gold, and investors ultimately should own a share of the stored gold bullion

- The Gold ETF must have a decent size and liquidity

- Must have reasonably fees

- Must have low tracking errors with Gold market price

I have to mention that the most important factor is a safe jurisdictions because, in time of crisis, governments will impose Gold holding restrictions. Some governments have even previously confiscated Gold from citizens, just check these history facts:

- In 1933, the U.S. issued Executive Order 6102 requiring everyone living the U.S. to turn in gold coins, bullion and certificates.

- During World War II, the British Government ordered all citizens to sell their gold to the treasury.

- In Australia, Part IV of the Banking Act 1959 allowed for the government to seize private citizen’s gold for fiat currency. It has since been repealed.

- In Germany, as of the 1st of January of 2020, the limit to buy gold anonymously dropped from €10,000 to €2,000

You may be tempted to start owning Gold ETF with names like Invesco, Xetra, Gold Ishares Physical Gold, SPDR Gold Trust GLD with a low commission of 0.15% or 0.2% because these are big names on markets, but I don’t recommend them, as these ETFs are actually an obligation, or a debt note against a commodity.

Instead of having shares in a fund that directly owns the asset, such as gold, you essentially have a contract with a 3rd party Bank that guarantees your exposure to the asset. Generally, this should be a NO WAY TO INVEST IN GOLD because it would expose you to unnecessary counterparty or issuer risk.

We prefer to pay the doubled commissions to hold ETFs which own the physical bars of Gold and after a long time of research, I found that the only options are ZKB GOLD ETF and UBS GOLD ETF from Switzerland.

Just read the fund prospects below:

ZKB

The total expense ratio amounts to 0.40% p.a.. The ETF replicates the performance of the underlying index with a collateralised debt obligation which is backed by physical holdings of the precious metal. The ZKB Gold ETF A (CHF) is a very large ETF with 3,225m GBP assets under management. The ETF is older than 5 years and is domiciled in Switzerland.

UBS

The UBS ETF (CH) Gold (USD) A-dis invests in gold.

The total expense ratio is 0.23% pa Index performance is tracked by a bearer bond backed by physical precious metal holdings. The UBS ETF (CH) Gold (USD) A-dis is a very large ETF with a fund volume of CHF 1,700 million. The ETF is more than 5 years old and set up in Switzerland.

Between ZKB and UBS, we prefer to invest with ZKB (Zürcher Kantonalbank) because is the largest cantonal bank and the fourth largest bank in Switzerland owned by the Canton of Zurich.

Thanks for reading, and please share your other options to own Gold on Facebook page or Comment section of the blog!

View Article with Comments