Last week Bitcoin lost over 20% in two days only, from 21000 to 15700. Other broader crypto markets were also sold off heavily: Ethereum dropped 15% touching 1330$, also Dogecoin, Cardano, Ripple which lost double digit percent. FTX’s native token, plummeted about 75% last week to record lows, as the crypto exchange faced a bank run amid increasing doubts over its finances. Binance CEO Changpeng Zhao said that the world’s largest crypto exchange signed a deal to buy FTX operations outside the U.S, only a few hours after FTX suspended client withdrawals.

FTX’s bankruptcy is the most important crash this year, because of the growing pressure from rising interest rates. The exchange follows of Celsius and Voyager Digital in suspending withdrawals due to a severe liquidity crunch.

Crypto market capitalization is situated now below 1Trilion$, from 3Trilion$ two years ago.

Why I don’t like to trade Bitcoin or Crypto right now instead of lower valuation?

- The economic situation in the world continues to deteriorate due to the rising inflation, which involve an increase in the cost of mining equipment.

- China economic growth, which is the second largest bitcoin mining country, is at multi-year low levels. As a result, this will lead to an accelerated decline in investment interest in high-risk assets, which include also cryptocurrencies.

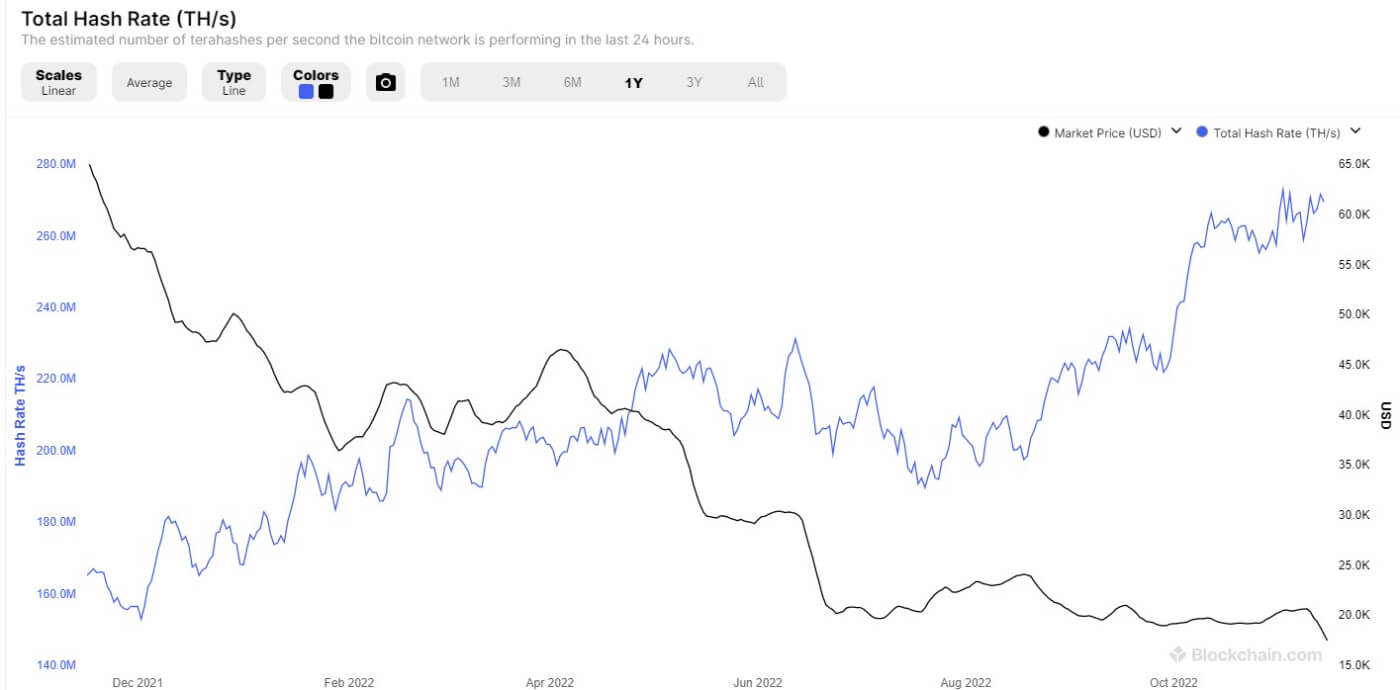

- Competition among miners is at multi-year high. Just check the chart of Total Hash rate (Th/s) below compared to BTC

- Mining Hash rate is a key security metric. The more hashing (computing) power in the network, the greater its security and its overall resistance to attack. Although Bitcoin’s exact hashing power is unknown, it is possible to estimate it from the number of blocks being mined and the current block difficulty.

- Mining Pulse (monitor activity of miners), the most important metric to predict the price of Bitcoin, is at record low levels which adds a lot of pressure for block chain stocks like RIOT or HIVE.

- FED Interest Hike is a major negative catalyst to the price of Bitcoin and the situation will not change until the end of rate hike cycle. Maybe at the end of 2023 we will see the prices over 30K.

- Bitcoin capitalization is too low, is under 50% from Apple Stock right now.

- Volatility is too high for my risk appetite. High Leverage need a lot of money to trade 5 to 10 contracts to make a sound money management strategy. For small Investors, the minimum capital is 100K to trade 5 Contracts.

After the bankruptcy of FTX, many investors moved to Gold that touched to 1776 in one day, right now nobody can claim that BTC is Gold, BTC is nothing. I will start to invest in Bitcoin when all the central banks and large commercial banks will put their money into BTC. I really appreciate Block Chain technology because it will revolution many economic sectors like banking, medicine, auto but this is not enough to put your money into BTC. Maybe BTC was developed to experiment a new form of money in society and we will not be surprised to find that, in the future, FED will adopt a new money standard.

Just check Powel statement below in January:

"We look forward to engaging with the public & paper not intended to signal it will make any imminent decision about the appropriateness of issuing CBDC"

...and read our article from 21 January: Russia will ban Bitcoin & FED will launch his own Crypto at https://topfxinvest.com/blog/bitcoin-crash-russia-ban