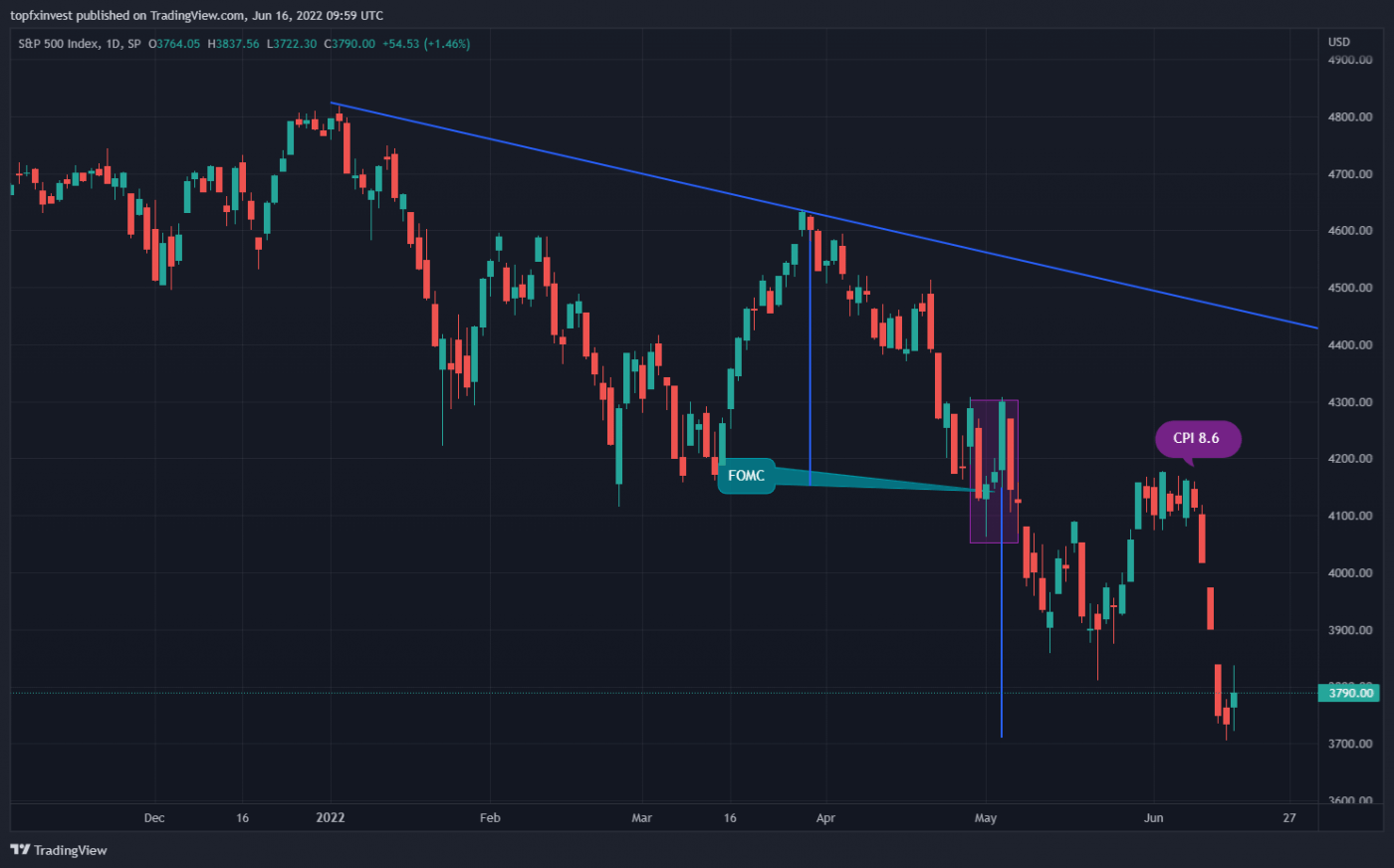

The FOMC (Federal Open Market Committee) meeting consensus was for 50bp rate increase because of this week's worst CPI reading, but Fed hiked with 75bp, and market consensus agreed for other future rate increase this year, and also a 10% inflation which is on the cards right now. Markets are hit hard this week, a Risk-OFF tone was the main trading sentiment among traders.

How Dot Plot was changed:

- June 2022 shows the median rate at the end of 2022 at 3.4%, up from 1.9% in March 2022

- For 2023, the median Fed funds target rate is up to 3.8%, up from 2.8% in March 2022

- In 2024, the Fed projects a Fed funds target rate of 3.4%, down 40 basis points from the end of year 2023

10 to 1 votes for 75 bp hike and Powel opening statement “Inflation is much too high” reveal large consensus and fear from actual economic environment.

Jerome Powel other key statements from yesterday meeting:

- Consumption spending is strong

- Housing Market is slowing

- Tightening in financial conditions could continue to temper growth

- Growth in business fixed investment is softening

- Labor market is extremely tight

- Wage growth is elevated

- We'd been expecting to see signs of inflation at least flattening

- We're seeing inflationary forces everywhere

- We don't know what will happen with supply shocks and how long they will last

- Pace of hikes will depend on incoming data

- Does not expect 75 bps moves to be common. Either 50 or 75 bps seems most likely at the next meeting.

SP500 are at the worst levels for this year, and inflation is at the highest levels because of the Covid-19 outbreak and the war between Russia & Ukraine.

Beijing and Shanghai (China) are experiencing a "strongly explosive" COVID-19 outbreak right now and this will add fuel to the fire of the Recession. Even Chinese Communist Party Media disclose some information on this new Covid-19 wave (https://www.globaltimes.cn/page/202206/1267831.shtml) but you can read more unbiased opinion at Voanews: https://www.voanews.com/a/beijing-sees-explosive-covid-outbreak-shanghai-conducts-mass-testing-/6613499.html. Authorities ordered PCR testing for all residents in 15 of Shanghai's 16 districts this weekend, and five districts have restricted residents from leaving home during the testing period.

What about recession?

Goldman Sachs SP500 forecast SP500 to 3150 according to David Kostin only if the EPS estimate moves to $225.

Morgan Stanley is looking for a "tradeable low" in the SP500 suggesting price 3,400 because "growing evidence of slowing growth and the risk to earnings”.

Our Portfolio Recommendations

Regarding our Portfolio we added some Gold this week at the price 1815 and also ZIM stock instead of Economic tailwinds. We like ZIM because they have signed new charter agreements on eco-friendly vessels to expand its services. ZIM is extremely undervalued at PER 1.83 and also, it’s a company with low debts. Company has huge cash in bank accounts of 2.8 billion $ that is equivalent to 40$ per share price. We bought at 49$ and we have a target of 75$ per share, without taking into consideration the past dividends.