We analyzed the last week's performance on each asset class and found that the most resilient category from year to date is Energy, REITs and precious metals (instead of the last rally down of Gold). It’s difficult to find a place to park the money 💵 in this economic and financial outlook. According to Warren Buffet, in a recession environment everyone loses, but some of the people have a small loss and others have high loss.

Even traditional safe heavens offered little protection in the first half of 2022:

- Bonds have historically grown when stocks have plunged, but Treasuries and municipals Bonds sold off in the first six months with -7%, S&P500 Corporate Bond Index is down 15%

- S&P500 is 19% down today, Nasdaq100 with 28% in red, Down Jones 14,5 % in red

- Crypto Markets Bitcoin & Ethereum have lost over 70% from high

- Commodities without energy-related doctor Copper have lost 23% and Cotton 17%

- Precious metals are best performers today with only 3,8 % loss

- Few REITs that have contracts related to interest rates also performed very well: VICI +8.5%, O -3.5%, UBA -0.8%

- Dollar outperformed marked DXY with +12%

So how did we get here?

We get here because of the high Inflation, rising interest Rates, record Energy Prices, war in Ukraine, Covid 19 pandemic and FED easy money printing in this decade. Everything seems to be a bubble.

How long will it last?

Risk off mode will persist this year and also at the beginning of 2023. History of bear markets from '49 tells us that we can stay in the red between three months and 39 months.

How much will the markets drop from Here?

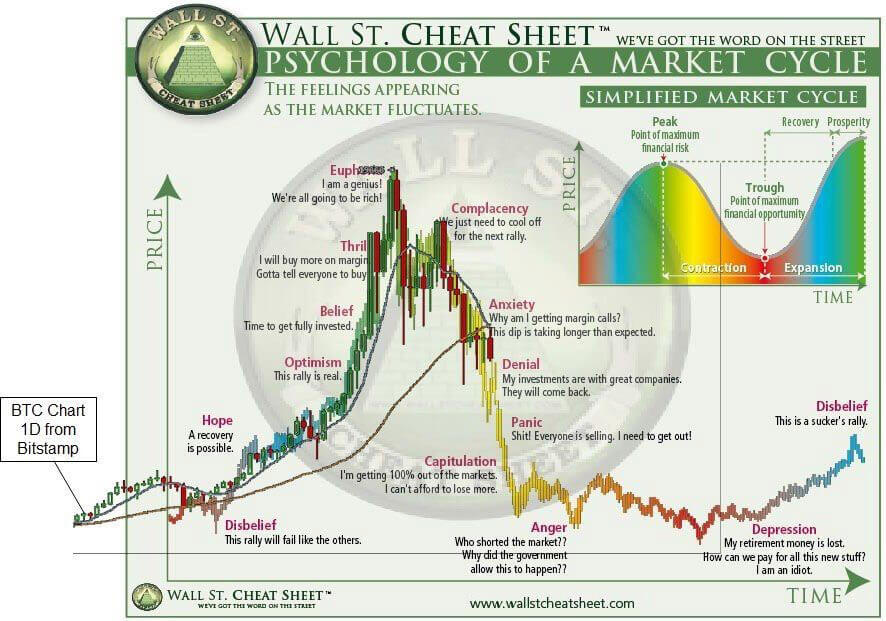

S&P has fallen from 30% to 60% in 13 bear markets. We are reasonable to accept a minimum of 10% draw down from here, but because of amplitudes of the factors that generate this financial cataclysm, we must see a much more loss in Equities. We must understand the psychology of markets and individuals to know how to act.

We think we are before of the Panic stage of the markets right now (see first image). What is your opinion on this current stage? Will appreciate your opinion on the TopfxInvest Facebook Page.

Many analysts that we consulted seem to indicate that a peak of inflation will determine a bottom for stocks. We don’t think that is a true scenario because of the magnitude of the factors that start this bear market. I would be extra cautious before making any big bets on stocks and I’m a big fan right now of high dividend stocks that are resilient to interest rates hikes.

How to act right now, do we have a place to invest?

We prefer to consolidate the Gold & Silver positions, also we started selling Energy & Commodities Stocks that outperformed the market (like Daco Energy DQ, CNQ). We think that Gold will rise after the FED will finish with rate hikes and the Dollar will lose some peace of growth. We also studied the history chart of EUR/USD and when the Dollar is on Parity with Euro, will have some correction on the Dollar Index.

Chuck Berry inspired this article with “No Particular Place to Go”

An interesting topic for a future article will be: How to identify fundamentals of a market bottom or how to store Gold in efficient & safe ways?

Thanks for reading, and I’m waiting your feedback for our articles on our Facebook Page.