After high Inflation in US and Europe, the Covid-19 pandemic outbreak, a new event like war between two major countries affected the markets. War between Ukraine and Russia pushed this morning Gold over 2000$, Oil to 124$, Soybeans 1686$ and Corn to 775$. During war times precious metals, Oil and Grains perform well instead of risk assets like stocks.

High level of sanctions from the Western Economies will destroy the Russian economy in the medium term. The Putin regime will fall in the near future because you can't win a war completely isolated from western world and you can't govern with terror and mass-media censorship.

According to the last Russian laws, you can get 15 years in jail if you transmit information from the battlefield that is not what the regime wants. All social media are closed, also internet websites like BBC, CNN, The Guardian etc. If the Putin regime it's not quickly removed, the Russian people will live like in the North Korea.

Also, some important brands like Toyota, Ford, BMW, Mercedes, VW, Oracle, SAP, Mazda, Nike, PayPal, Apple, IBM, DELL, Mitsubishi have closed the doors to the Putin regime. The Russian currency is moving down by over 30%, and the Moscow stock market is closed for three days in a row.

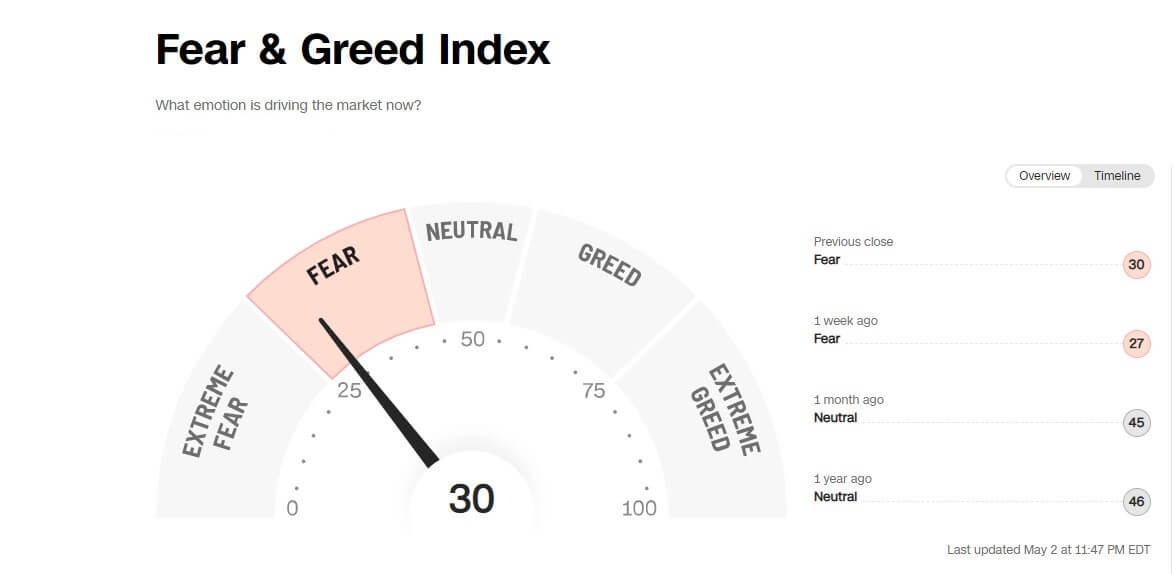

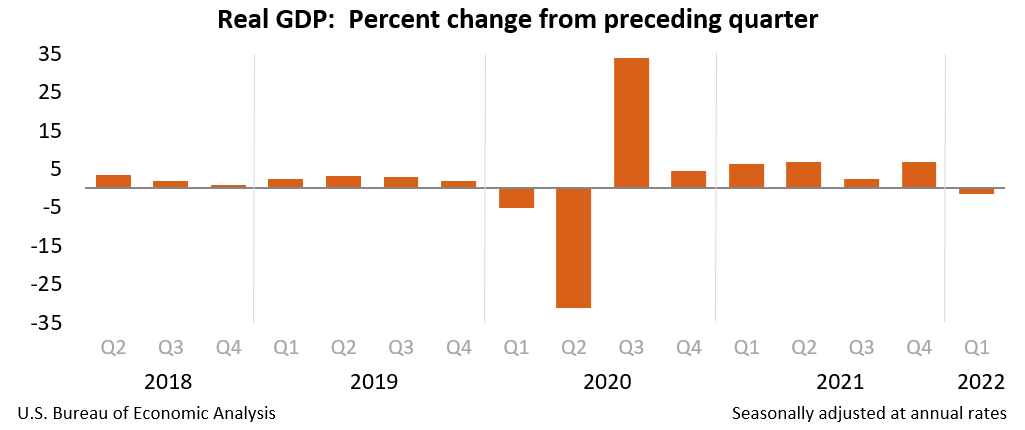

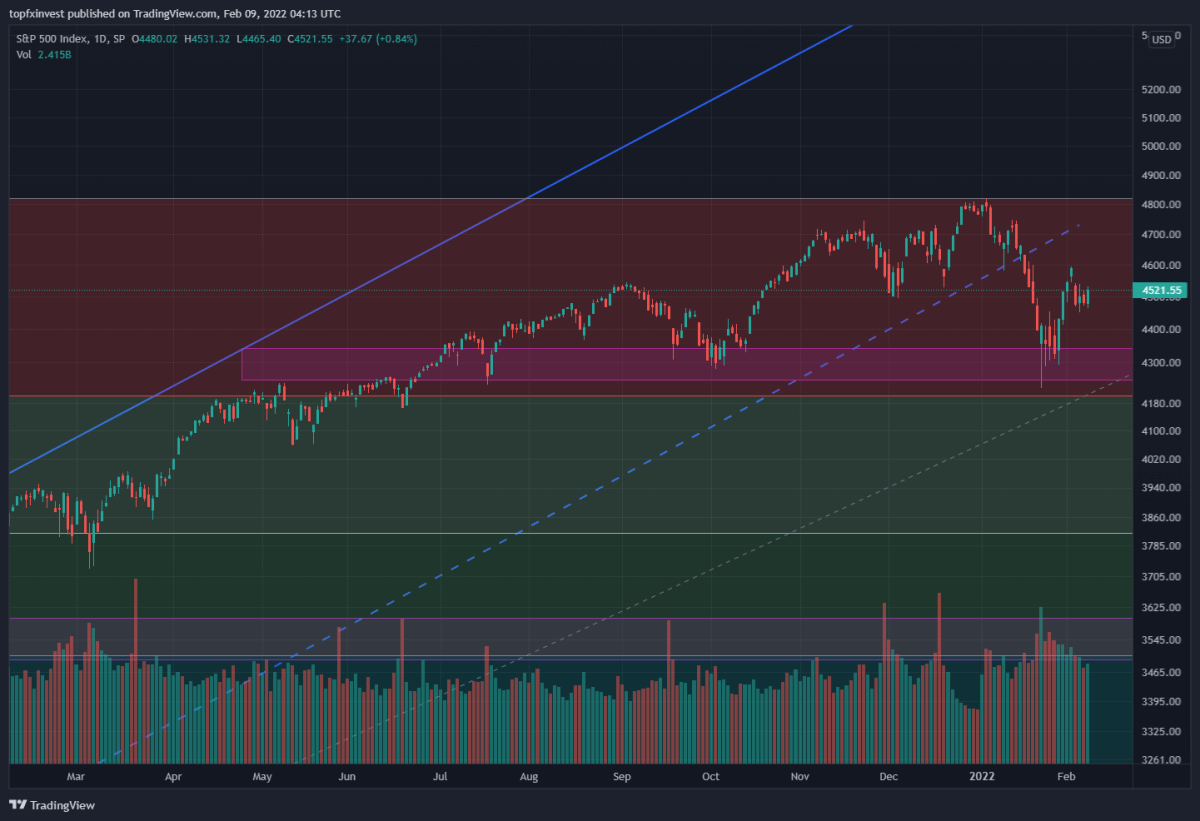

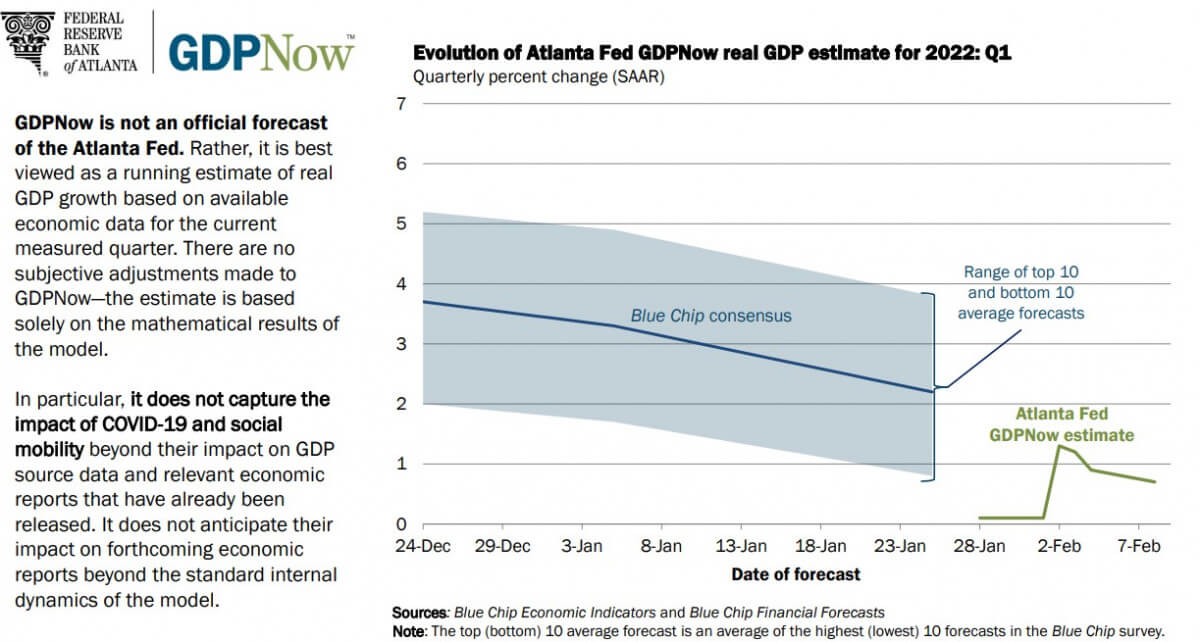

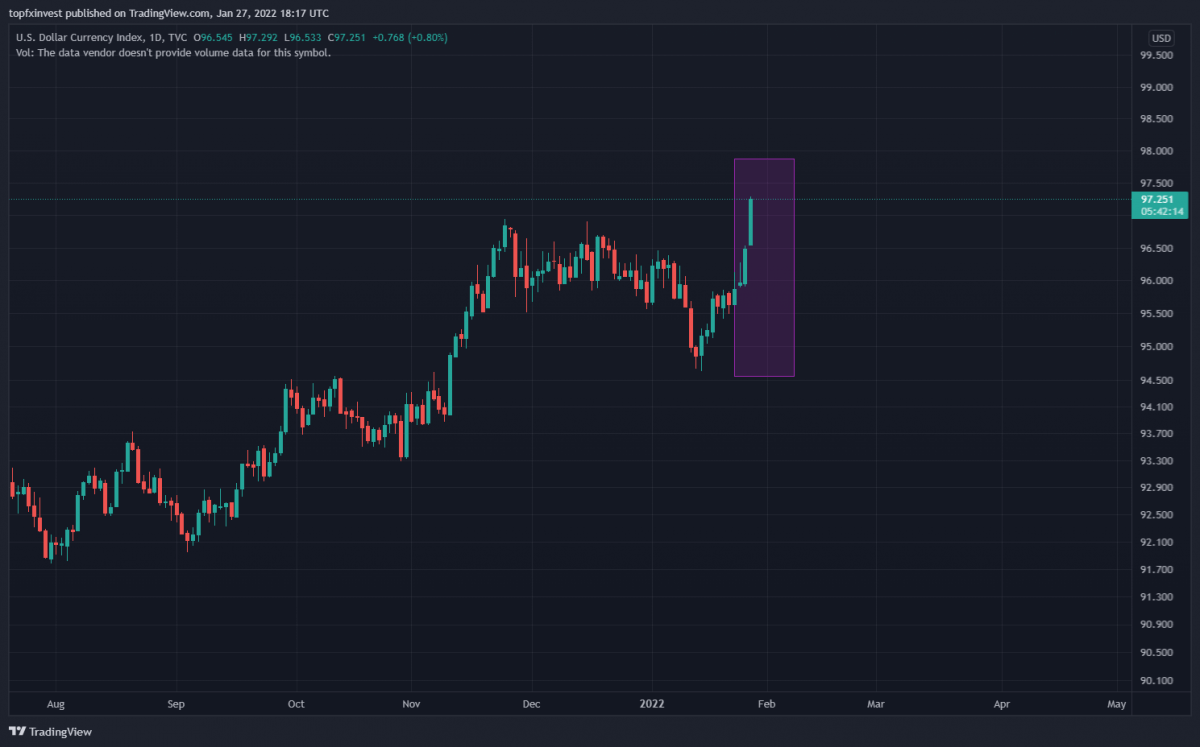

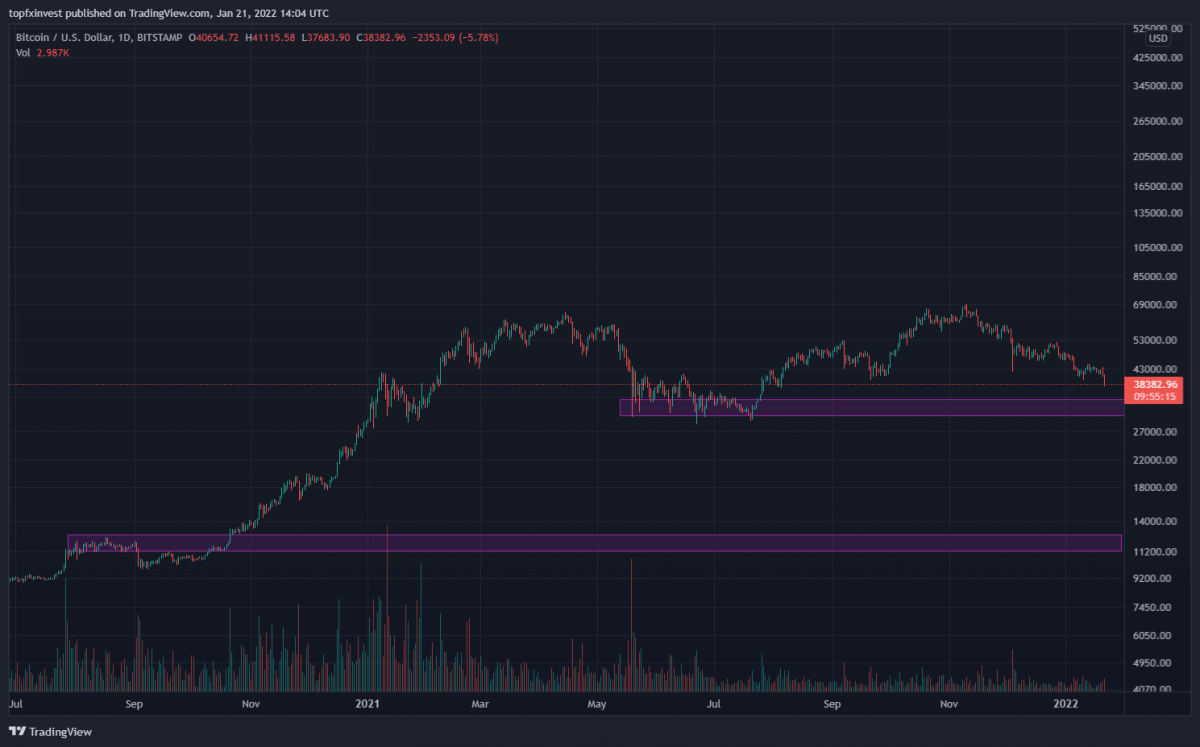

With the US & EU already facing the highest inflation in over four decades, triggered by the Covid lockdowns and restrictions, and the February CPI release this week anticipated to show an escalation during the previous month, the real possibility of an economic recession is even larger.

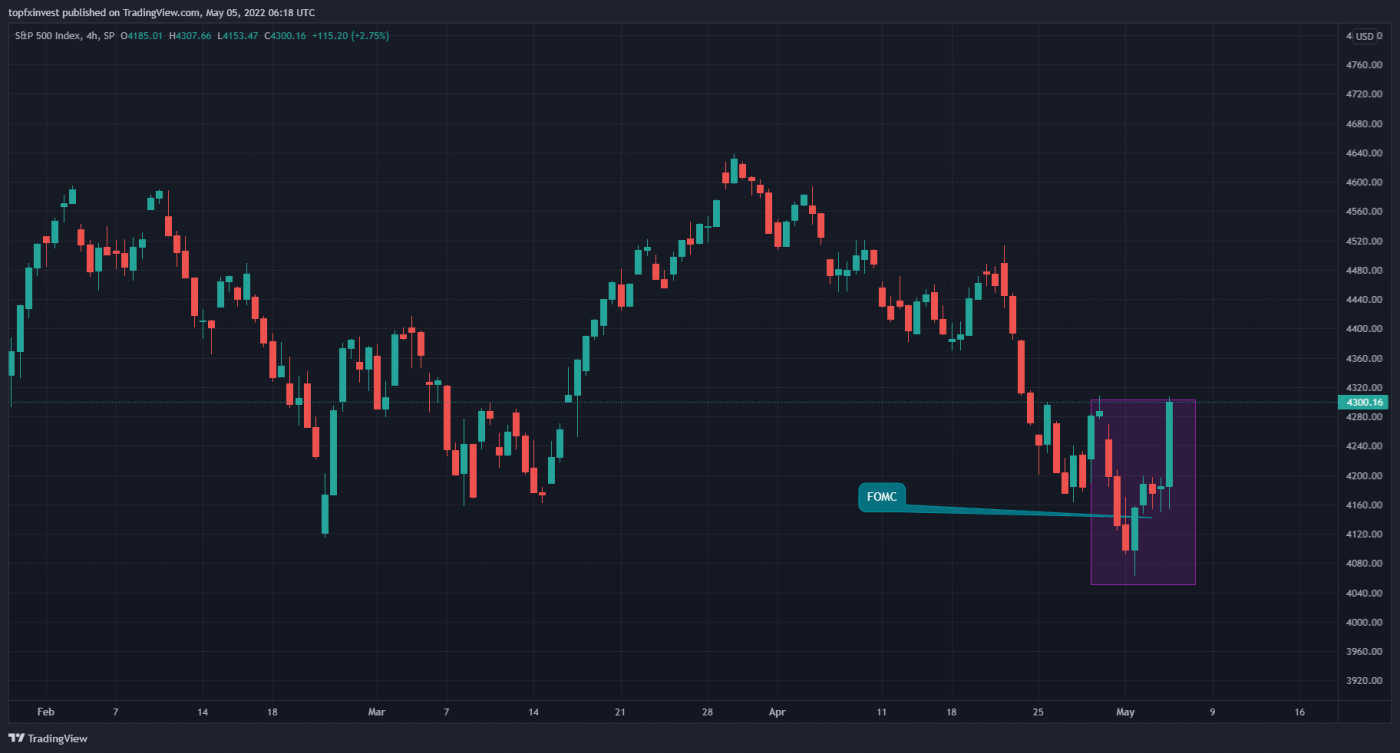

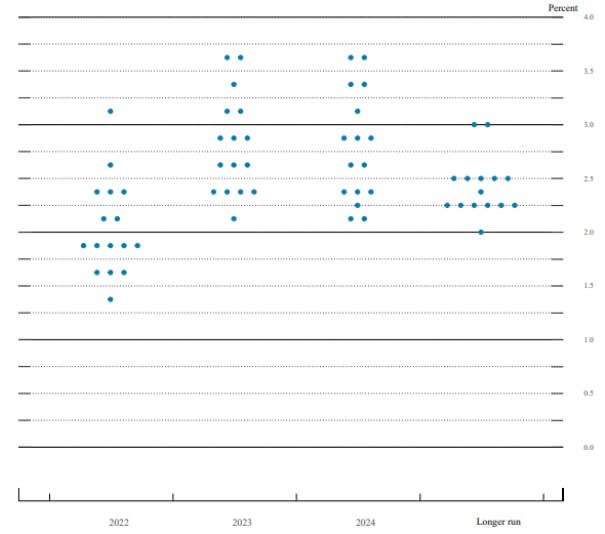

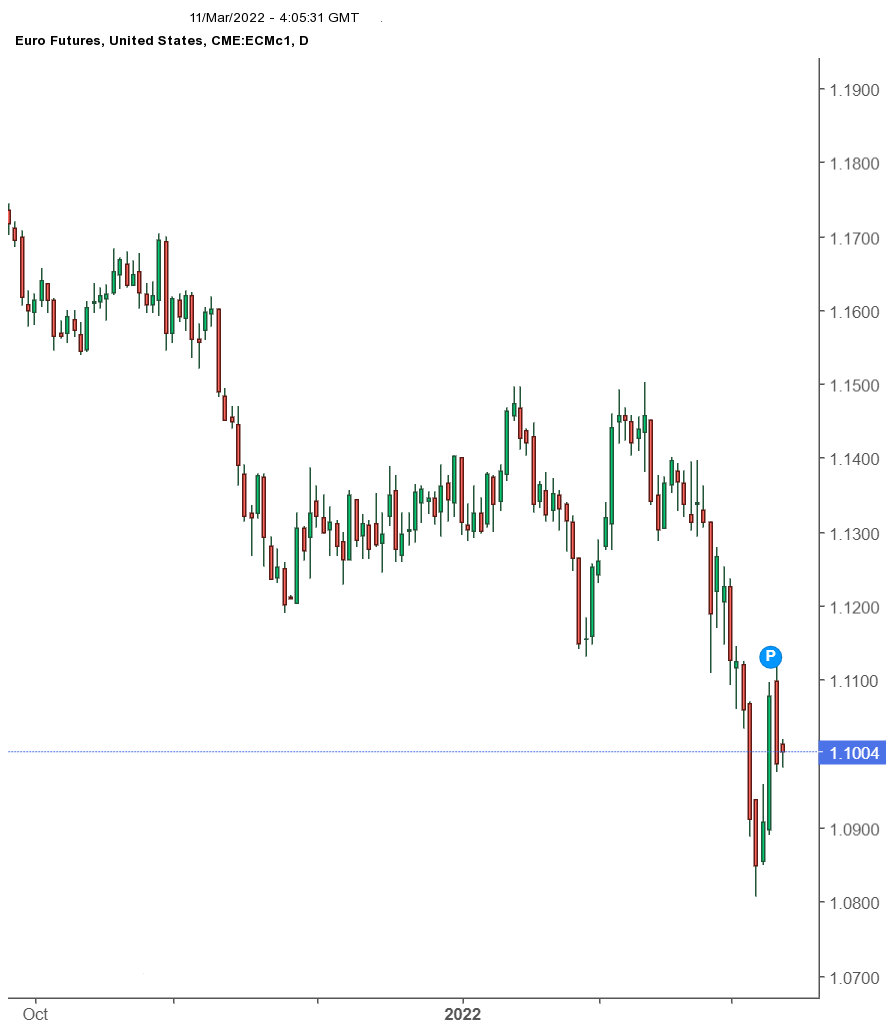

Therefore, the Federal Reserve's upcoming policy meeting on Mar. 15-16, will start a new interest rate hike cycle and it's not advisable to be exposed on the growth stocks. We still own high dividend stocks in the energy and finance sectors and also, we are keeping our Gold & Silver positions. We anticipate further weaknesses in stocks this month.

The United States and European allies are exploring banning imports of Russian oil, Blinken said on Sunday, and the White House coordinated with key Congressional committees moving forward with their own ban.

"A boycott would put enormous pressure on oil and gas supply that has already felt the impact of increasing demand. Prices are likely to rise in the short term, with a move toward $150 a barrel not out of the question Such a move will put further pressure on global economies, pushing inflation higher, leaving central banks debating how quickly rate hikes should be implemented." according to some analysts from CMC Markets.

"The war has clearly increased the risk of a stagflation scenario for the euro zone, where you will have a stagnating economy and much higher inflation on the back of high energy prices," said Carsten Brzeski, global head of macro at ING.

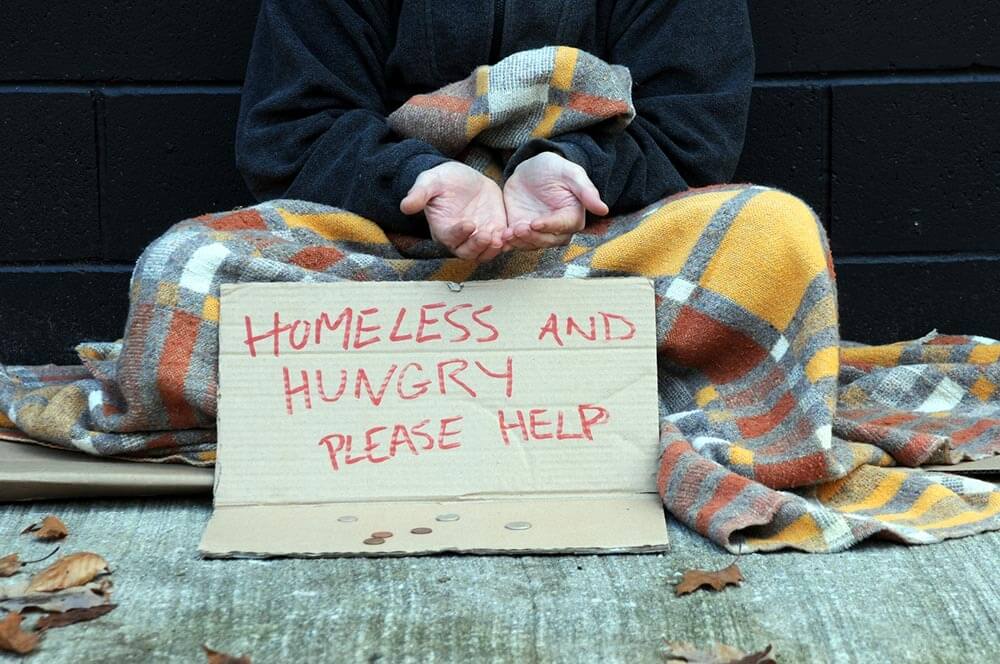

We stand with the Ukrainian people that fight for their freedom and we want to help mothers with children that are refugees. Right now, we are facing a real drama on the Ukrainian border as the refugee and their children are staying over three nights on -15°C without food and water.

It's estimated that there will be over 10 million refugees this year, if the conflict does not stop soon.

If you want to help refugees, you can donate on these links:

https://www.unicef.org.uk/donate/donate-now-to-protect-children-in-ukraine/

https://donate.unrefugees.org.uk/ukraine-emergency/~my-donation

https://donate.redcross.org.uk/appeal/ukraine-crisis-appeal

https://www.icrc.org/en/where-we-work/europe-central-asia/ukraine

https://www.savethechildren.org.uk/

https://donate.careinternational.org.uk/page/100263/donate/1?ea.tracking.id=e75_orgsocial

https://www.peopleinneed.net/

https://msf.org.uk/

You can help Ukraine Army here:

https://www.portmone.com.ua/r3/uk/terminal/index/index/id/118103/

Слава Україні! (Slava Ukraini!)

Glory to Ukraine!

View Article with Comments