Yesterday FED hiked rates by the expected 50 basis points to 4.50%, but surprised by hiking also the terminal rate to 5.1% at their last dot plot in September. They also raised the inflation forecast for the end of 2023 to 3.1% from 2.8% and the core PCE to 3.5% from 3.1%. They don’t see inflation moving toward the 2% target until 2025.That was extremely bearish for Stocks, S&P lost from +1,2% to -0.6% on market close, yesterday was an important sentiment change.

What to expect from this point?

U.S. stocks were higher last week, having rallied 15% from October lows. U.S. Treasury yields fell, causing the yield curve to invert by the most since the early 1980s. I don’t think stocks are fully pricing in the recession we see from the FED over tightening policy. The FED will eventually stop its rate hikes next year, but we’re not expecting large & successive rate cuts that the market is pricing in.

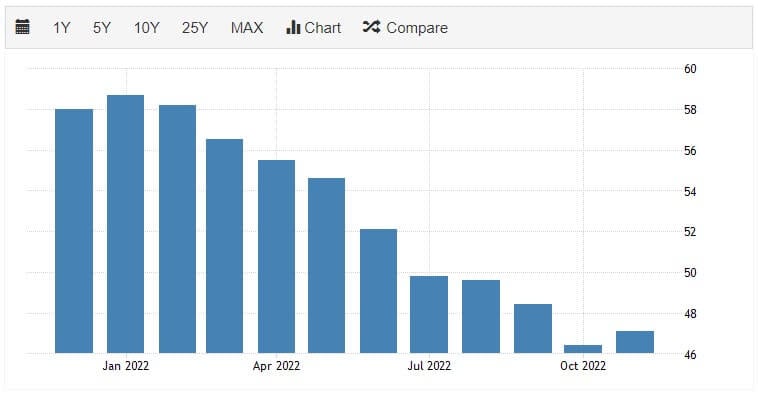

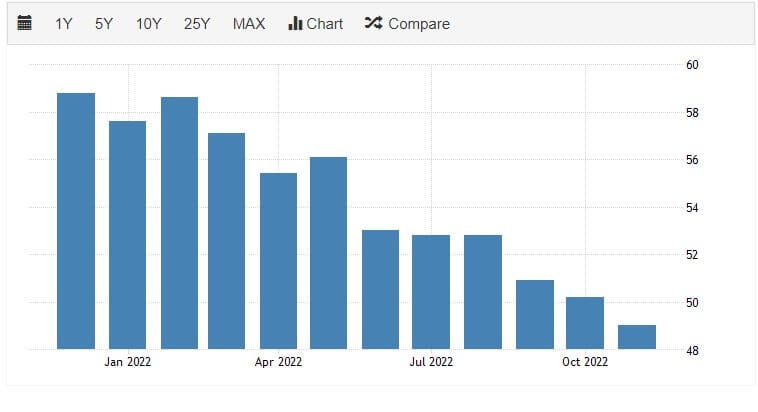

Economic activity is continuing to slow in the U.S. & Euro Zone, according to the flash Purchasing Managers’ Index for November.

EURO ZONE PMI

US PMI

In the U.S., services activity has been contracting for some time, but manufacturing also contracted last month for the first time. Readings for manufacturing are at the same levels with readings during recessions in 2009 & 1991, we’ve had a fifth month of factory activity decline in a row.

It’s evident that rate hikes from major central banks, especially FED it’s a major catalyst to lowering economic activity but the size of the damage will depend on how much it will hike in 2023. We expect that the FED will stop hiking at the beginning of 2023 but will not curb inflation to 2%. In the next year, we’ll register persistent above the target inflation and lower economic activities. Major spending shifts and production constraints are driving inflation higher. We don’t expect that the FED will start to lower rates next year.

Greater Volatility it’s our main expectation next year because production constraints triggered by the pandemic (China Lock-downs) and the war in Ukraine are pressuring the economy and inflation. It's a higher risk to own stocks and bonds investors need to have short time frames between market cycles.

It will be difficult to fight with inflation for FED because of the aging population and bad demographics in the US.

Why We are Positive on Gold?

Because Gold it’s the best way to preserve value and right now it’s started to climb higher from 1600 to 1800. Gold it’s the ultimate way to hedge against these complicated macroeconomic environments. Traditionally 40-60 stock/bonds portfolios allocation is not recommended because we have a direct correlation between stocks and bonds.

Economic consensus is for weaker growth, small recession (soft landing according to Powell) and ending rate hike cycle. How does this economic outlook influence Gold?

- Further weakening of the dollar as inflation recedes it’s positive for Gold

- Geopolitical conflicts are good catalyst for Gold

- Economic growth in China, after two years and half of lockdown, next year will improve Gold

- Further weakening of the dollar as inflation recedes would provide support for Gold

Downside risks also exist for Gold via a soft landing scenario, where business confidence is restored and spending rebounds. Risk assets would likely benefit and bond yields remain high – a challenging environment for Gold.

Gold Stock Miners ETF (GDX) already bounced and offers leveraged exposure conservative investors could try our ETF with Gold backed (ZKB GOLD & UBS ETF GOLD). Read more in article Why to invest in Gold and how to store it from 26 July.

One of our best bet stock last month was IAUX i-80 Gold Corp with 35% upside because of incredible result from Ruby Hill Nevada Project.

Our worst performer was SHWZ Medicine Man Technologies with -5% but we are still positive about this company.

To your future success!