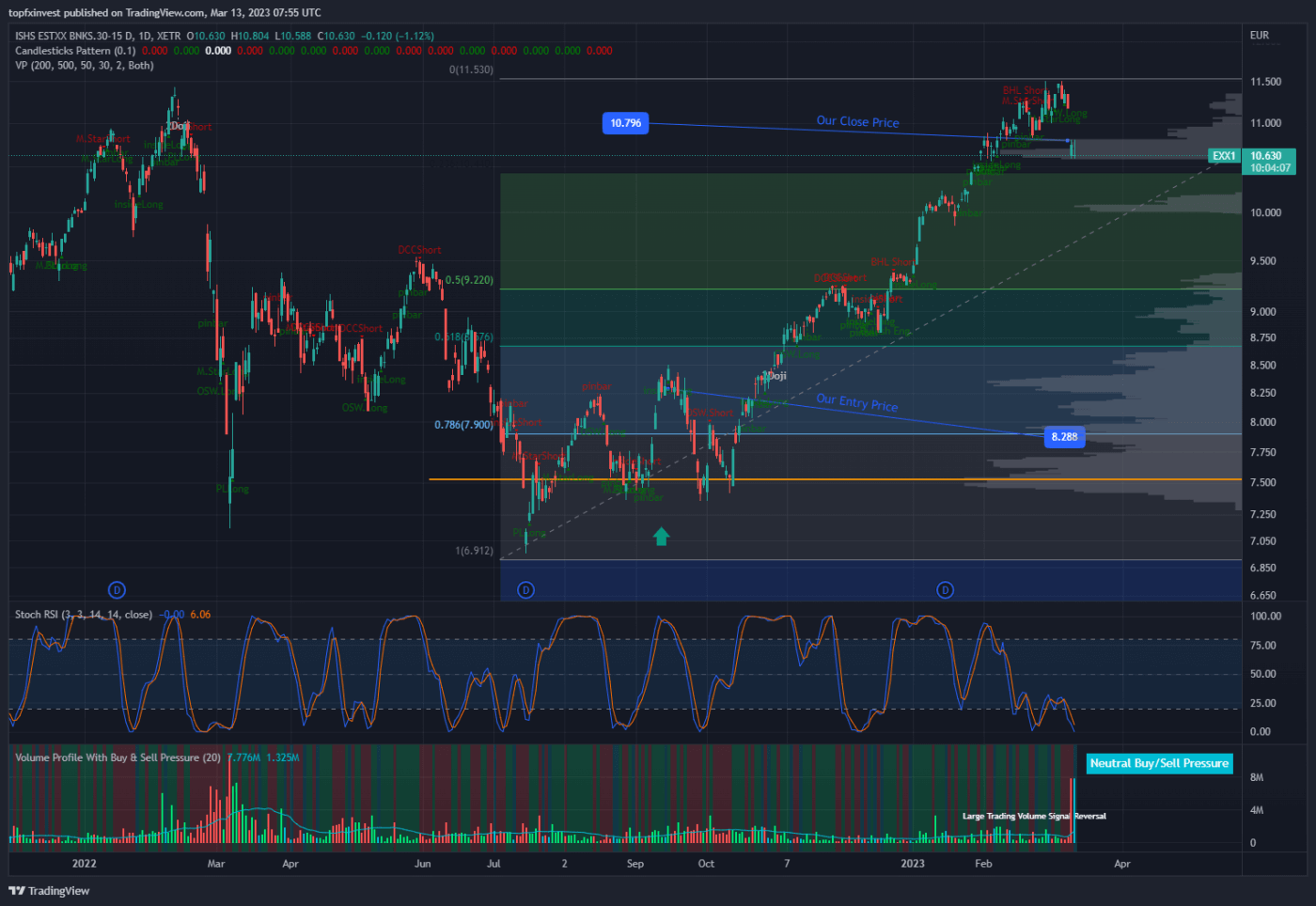

On March 8th we closed our European Banks holding position because of the negative news regarding bankruptcy of SVB Bank and the bad news sentiment regarding the financial sector. With 26% profit it’s not as bad, but our decision was related also to some other factors that affected the financial sector, which we’re going to describe next in this article.

The SVB Financial Group (SIVB) fallout is creating a mini credit crunch, with the banks stocks dropping aggressively. However, the SVB fallout reveals that banks are in trouble again. We don’t think this is even close to the 2008-type financial crisis because SIVB it’s not a major player in the arena. SIVB it’s a bank that used to fund IT&C projects with an easy credit policy. The fallout of SVB Financial Group (SIVB) is close related with rising interest rate from FED because many IT&C companies can’t pay the debt.

Our selling order it’s not related only to SIVB bankruptcy, other catalyst will also affect the financial sector.

The starting point to understand the current banks' troubles is the Fed's massive liquidity injection during in response to COVID. The Fed injected $4.7 trillion into the financial system from 2020 to 2022 via asset purchases or QE. Instead of making the loans, commercial banks bought the safest assets - Treasury Bonds.

You can read more here https://www.stlouisfed.org/on-the-economy/2022/january/have-fed-asset-purchases-reshaped-bank-balance-sheets-part-1 about banks reaction to Fed capital injection.

Some of the bonds are held to maturity (and any capital gain/loss is not included on the income statement) by banks and other bonds are available for sale. Banks significantly increased their purchases of the Treasury bonds as the Fed expanded the money supply.

For the securities available for sale, the realized capital gain/loss is recorded into balance sheet but banks must sale them to raise capital. These securities available for sales have huge unrealized loss in 2022, because the bond prices fell and interest rates increased.

Most important two things will affect banks performance

Deposit Withdrawals. It’s another major concern for banks because, from December 2022, deposits started to decline with a 2.5% rate, largest percent from 1970. Clients are closing deposits at these huge rates because they need to cover the cost of living which is affected by inflation. This trend will accelerate as the Fed continues to increase short term interest rates. When deposit will deplete, banks will face huge losses because they need to sell securities with huge losses. Other scenario is that the banks might have to increase the interest rates on savings accounts which would affect the overall profitability.

Bad Loans will be also a major reason to worry. Given the huge rate increase on car loans, mortgages and commercial loans, it’s reasonable to have an increase in the defaults. This scenario it’s the 1929 great depression and it’s interesting how the Fed will face this. The Fed can simply lower the interest rates and push the bond prices higher but also the Fed it’s forced to fight inflation until reaches 2% to keep the monetary policy tight.

We recommend to close positions into financial sector and to invest into Gold until market sentiment will improve. Gold was one of the very few bright spots in a dismal 2022, ending the year essentially flat, and I expect its performance to remain strong in the year ahead. We have record retail demand (check here https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2022) and demand for Gold ETF it’s at highest level.

We are headed into a recession because:

- Money supply is falling. There is an old school monetary theory that asserts a decline in the money supply actually causes a recession (GDP=M2 x Velocity).

- The yield curve is inverted and the 10-year interest rate minus the 2-year interest rate is a negative 0.81%.

- Consumer Sentiment Is rising, but remains very low.

- Unemployment rate is starting to increase before recessions.

In the next article we will discuss how to hedge against macro-economic downturn that we are awaiting and why Gold it’s the best instrument.