We think today that Fed and Mr. Powell will search sooner rather than later for a pivot point policy to change things because we already have a higher restrictive economic environment. We should remember that, when Fed suggested last time in 2018 that “future course of policy was predetermined on autopilot”, the stocks collapsed and Fed backtracked. Now they are trying right to introduce “data depending” on their speech, just check what they have said on Sept 30:

“Monetary policy will need to be restrictive for some time to have confidence that inflation is moving back to target. For these reasons, we are committed to avoiding pulling back prematurely. Fed will proceed in a data-dependent manner.”

Fed will keep hiking until something will break up. Just check the Bank of England (BOE) intervention because of illiquidity on gilt markets, also the Bank of Japan which have announced their first intervention to support Yen against a stronger Dollar. These interventions calmed down the market but nothing is done to solve the major fundamental issues.

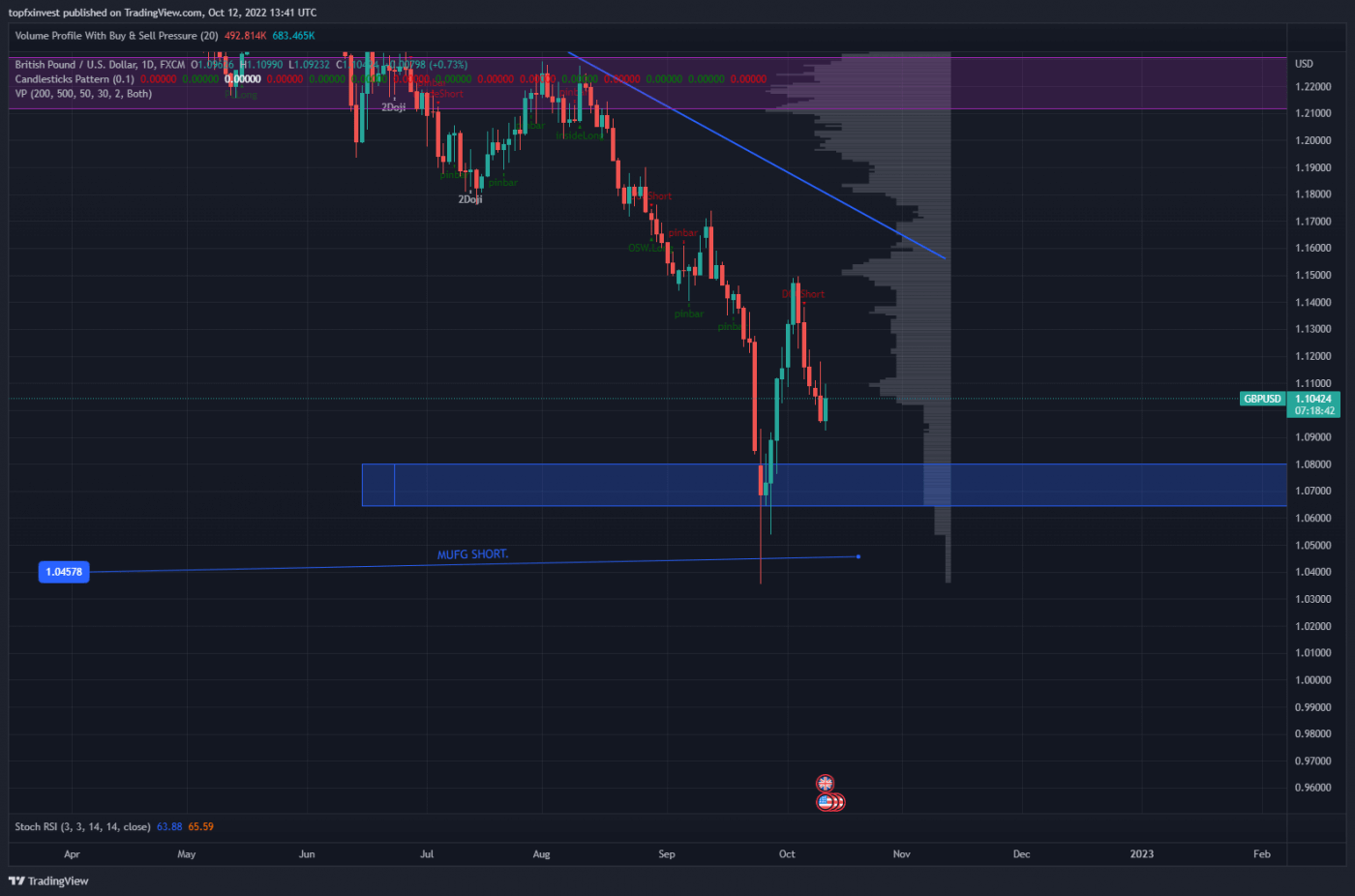

Just check the chart below for Pound ADR (Average Daily Range) of 500 pips. This is not a common sense movement.

But when will we see an inflection point for Fed?!

It’s all about the last Jobs Report which shows that is much stronger than expected, with a 263,000 monthly job gain while the Unemployment Rate had a major drop to 3.5% versus a consensus forecast of 3.7%.

Average Hourly Earnings is at the lowest point since December 2021. Stock market Futures are decreasing and bond yields are rising in the wake of a stronger than expected NFP. Inflation expectations have been on the retreat, but Mr. Powell still needs a lower job report next month to start change the monetary policy.

If we get a hot CPI tomorrow, while considering an improving job report in November, it could mean that we can’t expect a 125-bps worth of Fed hiking starting now, until the end of the year, but a 150-bps hike on December 2022. This scenario will be very bearish for S&P with another minimum of 300 points down from here.

If we will see a lower Job Report in November and December, therefore we could expect a stronger S&P from here.

Which Sectors Are Still Performing Better than S&P and What Are Our Exposure Today?

I don’t want to dig much further on this article.

We like the Energy Sector and we still have some good stocks like: CWEN, PIF, SU, VLO, TGA. Energy sector is the only branch on green this year. I think it’s too late to take new positions on energy right now, and if we see good news about the war in Ukraine, we will close some of our positions. Clean energy solutions will not solve this crisis, but it will be a part of the longer-term solution for improving the energy independence.

We have a great exposure on precious metals Silver & Gold, meaning 30% from our Portfolio. I’m still optimistic about Gold and I recommend to buy it after Fed will start changing its policy. Gold will be the first instrument that will start to grow. Gold registers a minus 8 percent year to date, but outperformed S&P with over 15 percent. We bought Gold between 1700 and 1800 and we expect a target price of 2000-2200 in the next year.

We are very bullish on Uranium, Lithium and Silicon because of EV market catalyst. We bought CYDVF (Cypress Development Corp), SQM (Sociedad Química y Minera de Chile S.A.), and bought again DQ (Daqo Energy).

The Financial sector it’s also one of our bets and will outperform S&P 500 because of the Rate Hike. Financial is in red year to date but emergent markets will outperform the US financial sector. We acquired Banco do Brasil (BDORY) because of a strong balance sheet and a good perspective on growth.

We have few opportunities to follow in a bear market and for us it’s an option to be exposed with 30% on cash until things will change from the FED side, maybe in the end of the first quarter next year it will be good time to acquire risk assets. What is your opinion regarding Stocks? Looking forward to hear your opinions in the comment section below.