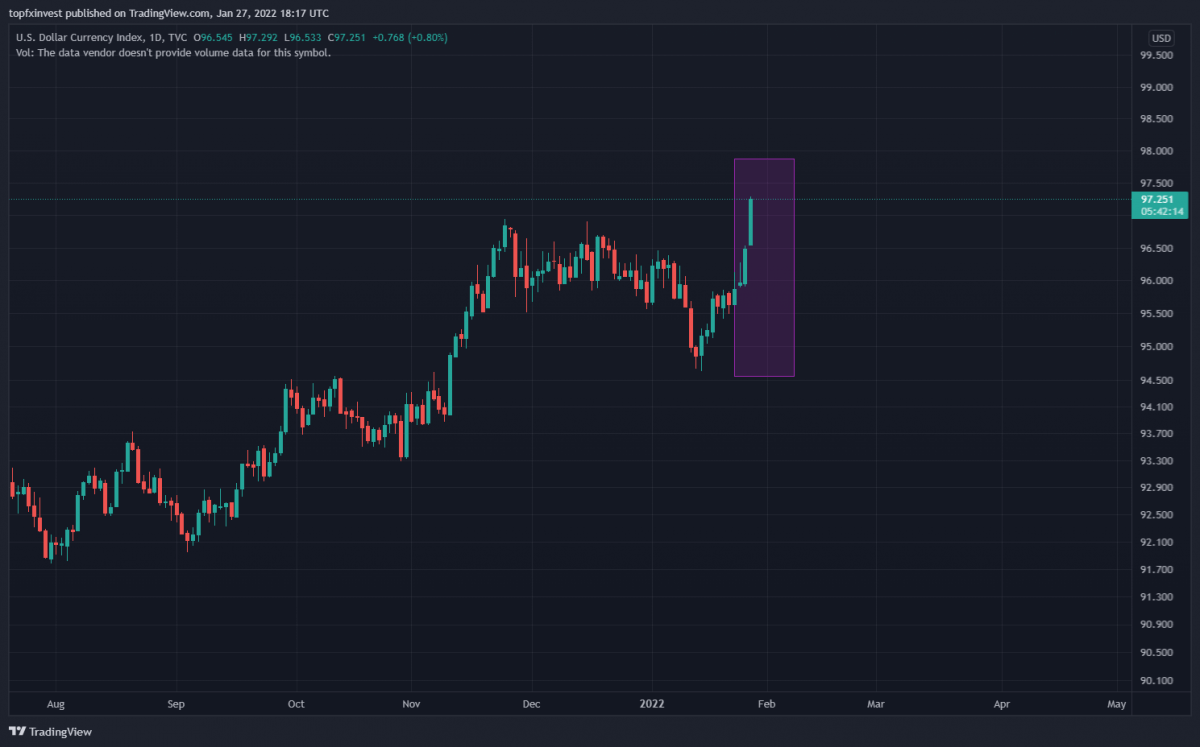

No surprise yesterday Fed leaves rates unchanged, as expected. Bank of Canada also holds rates at 0.25%. Stocks have no major Impact on Fed rate decisions. Before the news SPX500 growth was 2%, but closed at the end of the session in negative territory. Negative sentiment prevails on stock Markets but Dollar (DXY) is up according to our yesterday article regarding Bank of America. Grains are up with important gains.

Summary of FED announcement:

- Rates left unchanged 0.25%

- Taper pace unchanged but ending in March

- Taper was not expected to be sped up

- The Fed says it expects that it will soon raise the target range

- Risks are high from new variants of the virus.

- “Quite a bit of room to raise rates without hurting jobs. “

- We are of the mind to hike in March

- We may move sooner and faster on the balance sheet than before

- We will discuss balance sheet at the next two meetings

- Inflation risks are still to the upside, in my view

Market pricing suggests a 90% chance of a March hike