The rate hike was priced in and the market was on RISK-ON mode yesterday. Main question for the FED yesterday was, what percent will be the hike?

To stop inflation 0.5% was a better idea to hike but voters don't want to risk a recession with actual conflict between Ukraine-Russia. The surprise is 7 hikes in the dot plot instead of 5 hikes. The 10 years yield is now lower versus pre-rate decision level. Regarding the war in Ukraine, Powell said “The implications for the U.S. economy are highly uncertain, but in the near term the invasion and related events are likely to create additional upward pressure on inflation and weigh on economic activity. The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The implications for the U.S. economy are highly uncertain, but in the near term the invasion and related events are likely to create additional upward pressure on inflation and weigh on economic activity.”

Regarding the US Economy, we have below stances: “Indicators of economic activity and employment have continued to strengthen. Job gains have been strong in recent months, and the unemployment rate has declined substantially. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.” You can read full press release here:

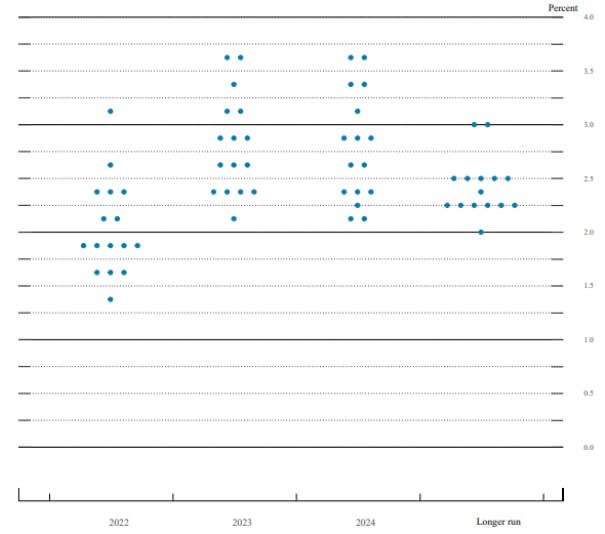

Surveying the FOMC's 18 members, the dot-plot showed that 12 FED officials predicted at least seven total rate hikes in 2022. On the high end, one FED official expects the central bank to raise rates above 3% during the year, from the level around 0.25% currently in force.

Please check below the dot plot below:

12 of 18 saw 0.9% in 2022, 11 of 18 saw 1,9% into 2023 annual median at 1.6%. Median interest rates for 2024 is 2.1%

12 of 18 saw 0.9% in 2022, 11 of 18 saw 1,9% into 2023 annual median at 1.6%. Median interest rates for 2024 is 2.1%

Macroeconomic implications:

Energy Financials Sectors will outperform, we consider that it's a good time to buy bank's stocks and sell High growth stocks like tech. Instead of a short term rebound for Nasdaq's & S&P500, we see down in the long run. I can't see inflation slowing down in the long term and 0.25 it's not enough to calm but the FED was forced by the actual Geopolitical climate.

Euro will be much weaker in the long run than the dollar. Unfortunately for the EU, in the Eurozone there are plenty of headwind that affect growth: price of energy, war between Ukraine & Russia.