Yesterday European markets news pave the road for an EU recession in the second half of the year.

- Eurozone April final consumer confidence -22.0 vs -16.9 prelim

- Economic confidence 105.0 VS Prior 108.5; revised to 106.7

- Industrial confidence 7.9 VS or 10.4; revised to 9.0 (Heavy Hit)

- Services confidence 13.5 VS r 14.4; revised to 13.6

Euro area economic sentiment continues to fall further as the Russia-Ukraine conflict is not seems to stop.

Sales are also down in Germany, March retail sales -0.1% vs +0.3% m/m expected prior was 7.

Selling price expectations rose to an all-time high of 60.8 - up from 57.2 from (that is not good for inflation).

How we would expect to protect ourselves from this possible recession:

- Bought Precious Metals Silver & Gold (Yesterday we added some silver because was a good price)

- Bought Defensive Stocks like Gilead's, Philip Morris, Imperial Brands, TeamViewer

- Bought some REIT stocks

- Bought Energy Stocks like: CNQ, PBA, ALVOF (too late to act now on these areas)

- Bought some stocks exposed to Agricultural land & Soils like ALCO.

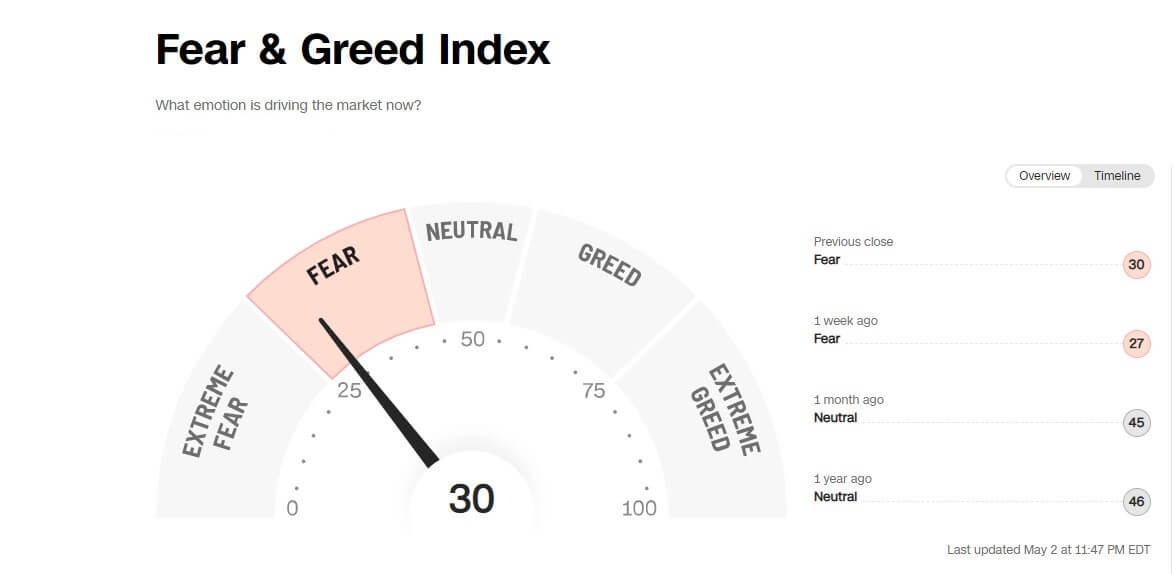

Fear is growing at Highest levels since 2008, just take a look on CNN Business FEARS picture above.

Our real time RIsk ON/OFF indicator.