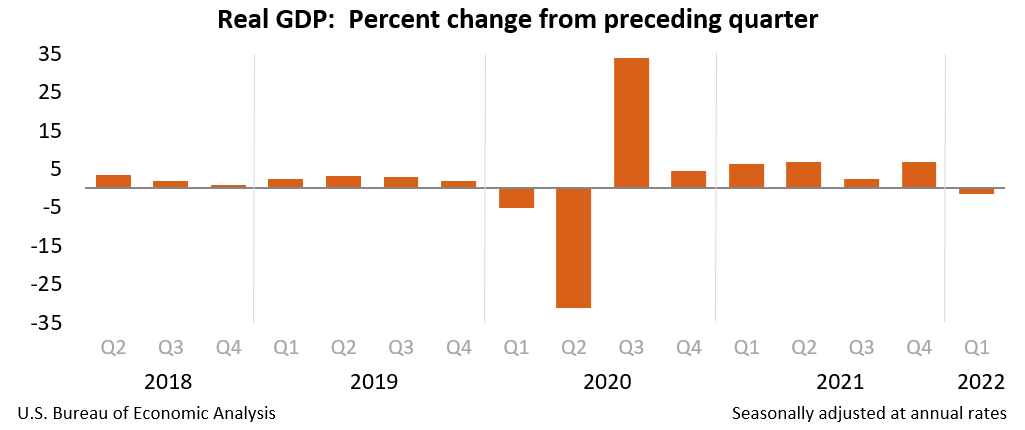

Yesterday, Advanced GDP was published and we saw horrible values with -2.4% deviation from expected values. All branches of the GDB were in red.

- Q4 final was 6.9% annualized

- Consumer spending +2.7% vs +2.5% prior

- Consumer spending on durables -4.1% vs +2.5% in Q4

- GDP deflator +8.0% vs +7.3% expected

- Core PCE +5.2% vs +5.4% expected

- GDP final sales -0.6% vs +1.5% in Q4

- Nominal GDP vs up 14.3% annualized in Q4

- Business investment +9.2% vs +2.9% in Q4

- Home investment +2.1% vs +2.2% in Q4

- GDP ex motor vehicles -1.3%

The decrease in real GDP reflected decreases in private inventory investment, exports, federal government spending, and state and local government spending, while imports, which are a subtraction in the calculation of GDP, increased. Personal consumption expenditures (PCE), nonresidential fixed investment, and residential fixed investment increased.

The Real problem for the US Economy it's not that GDP is an inflation of 8%.

Economic growth returned in the years after the 2008 recession. The US entered an era of low growth but well below previous recovery phases. That sluggish economy is why the Fed kept rates low and launched QE (quantitative Ease).Fed officials talked of letting the economy “run hot,” and tolerate a period of high inflation in order to restore long-term averages.

Covid 19 and Ukraine-Russia war is threatening to change this high inflation with hiper-inflation (over 10%).That suggests recession might be coming anyway in 2022-2023, even if the Fed weren't tightening policy.