Where are we today?!

Today, markets are in a recessionary stage because of more than a decade of financial bad investments; we are witnessing a process of money creation (Helicopter Money) to a scale that a few years ago was unimaginable for the financial world.

Money creation from nothing by the FED was growing with approx. 22% in 2020 because of the Covid19 pandemic outbreak, but if we have a look over the past 50 years, we have few times only 10 percent money increase from one year to another. To give you an idea about the magnitude of this move, it's a must to say that in WW2 money creation was only 15%, and it was further followed by a two digits inflation.

This process of money creation is happening at a global scale, including FED, European Central Banks and Japanese Central Bank.

What is Inflation?!

Inflation represents increases in the money supply, as a consequence of monetary inflation. If the FED will print more money, than a larger amount of money will chase the same amount of goods and services. Inflation it's happening also when production can't keep the pace, or when we have disruptions on transports of goods. Central Banks consider a small inflation as a good thing, as this will stimulate people to spend more money, therefore it also works as a catalyst for economy. It's famous that 2% represents a very good target for inflation.

When we have two digits inflation, we call it Hyperinflation, or inflation it's out of control, this being the worst scenario that could happen for an economy. There are many examples in the history, with hyperinflation that carried a huge negative impact over countries like Germany before WW2, Zimbabwe, Yugoslavia and Greece - more on this, at: https://www.cnbc.com/2011/02/14/The-Worst-Hyperinflation-Situations-of-All-Time.html

We talk about Deflation as the opposite process of inflation, when the money supply shrinks. In a Deflation scenario, a smaller amount of money targets the same amount of goods and services. As we mentioned earlier, a small inflation is considered good for economy, and this is also valid for a small deflation.

With little deflation, prudent investors are rewarded because their money are more valuable, but if we have an aggressive deflation (like 2008 scenario) the debtors are punished. High rates of deflation imply a high rate of defaults and further, shrinking in the assets value.

At the present moment, we are witnessing a deflation scenario because we register low discretionary spending. People changed their habits during the Covid19 pandemic, they now prefer low budget activities like watching Netflix with home-made popcorn, instead of going to the IMAX movie theatre. Very few from the middle class will celebrate anniversary birthdays on expensive restaurants with $250 champagne and Taxis.

Risk appetite will continue to slow down during 2022, a year that will be marked probably by more bankruptcies and lower corporate spending. Deflation is everywhere to be seen in 2022 and Governments will have to play a more decisive role for economies in the following years, as some sectors in the economies will start to collapse under the pressure of Inflation, while some others will be relieved under Deflation, thus creating a concurrent mixing Inflation / Deflation scenario, which emerged into a new concept: Crossflation.

What Is Stagflation?

Stagflation (economic stagnation) is characterized by slow economic growth, high unemployment rates, and a continuous pressure of the rising prices. Stagflation can be alternatively defined as a period of inflation combined with a decline in the Gross Domestic Product (GDP).

A challenging 2022 will bring more insecurity, but also new opportunities for informed investors that are willing to take risks.

View Article with Comments

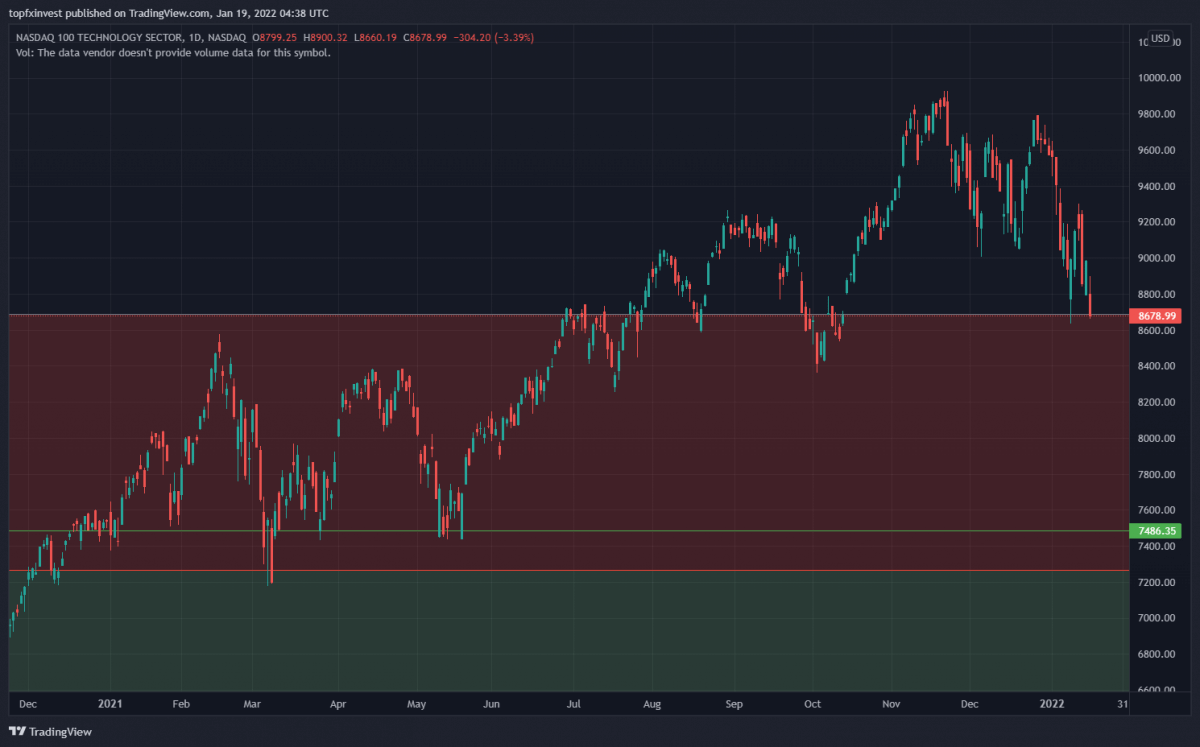

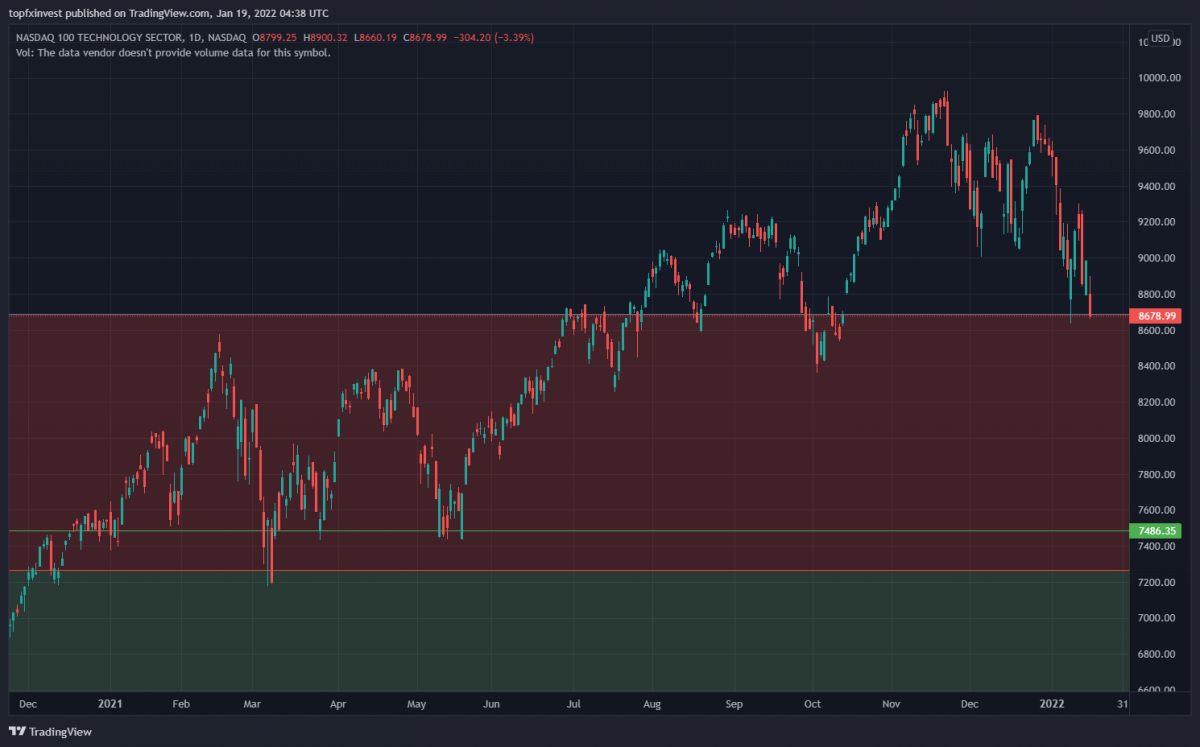

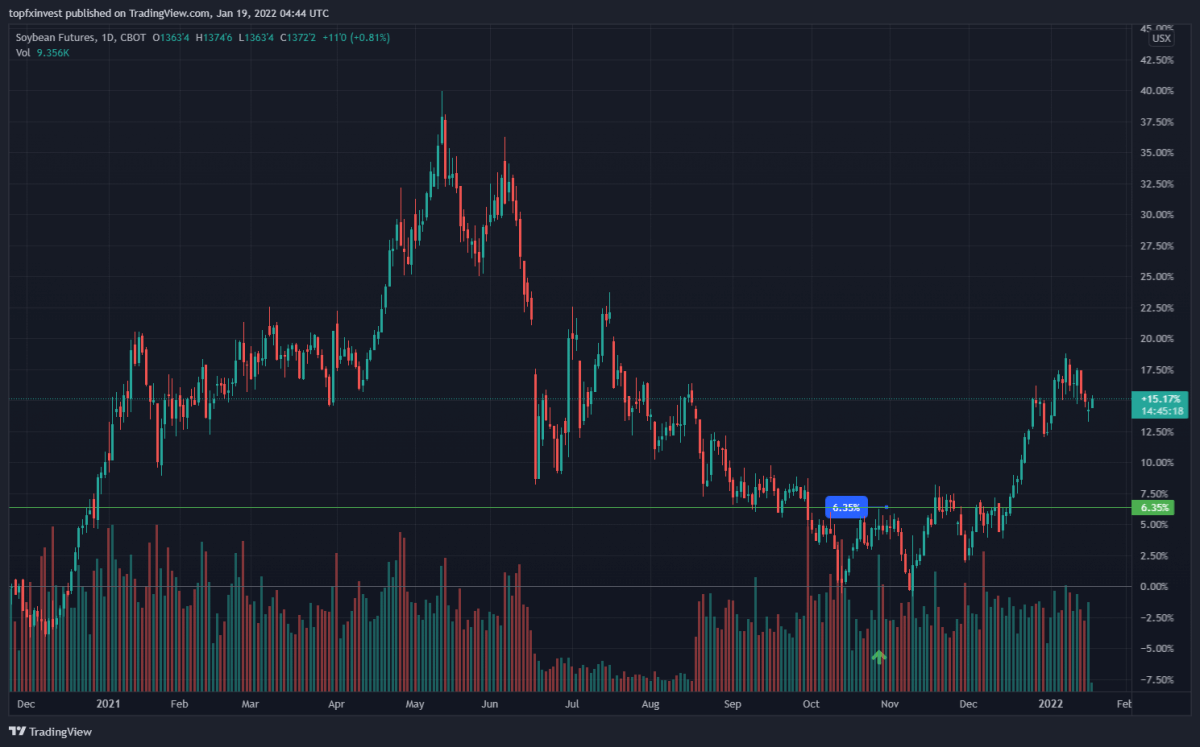

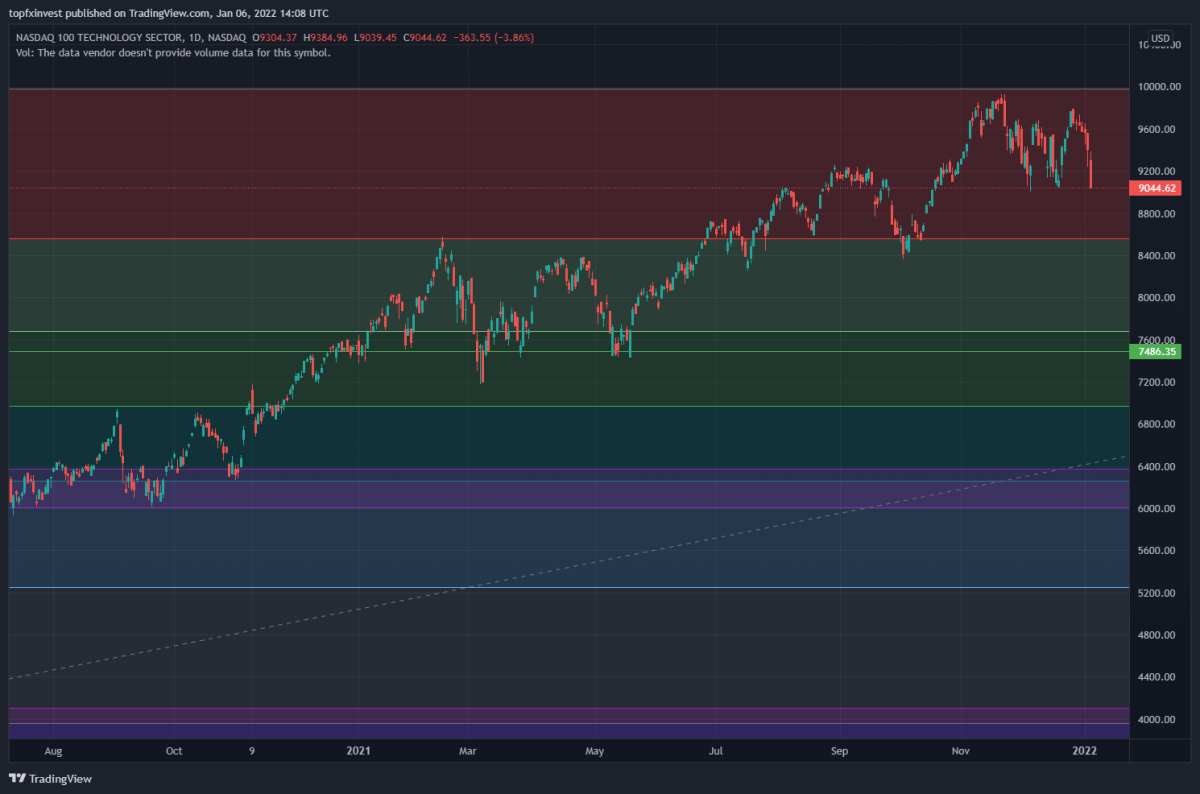

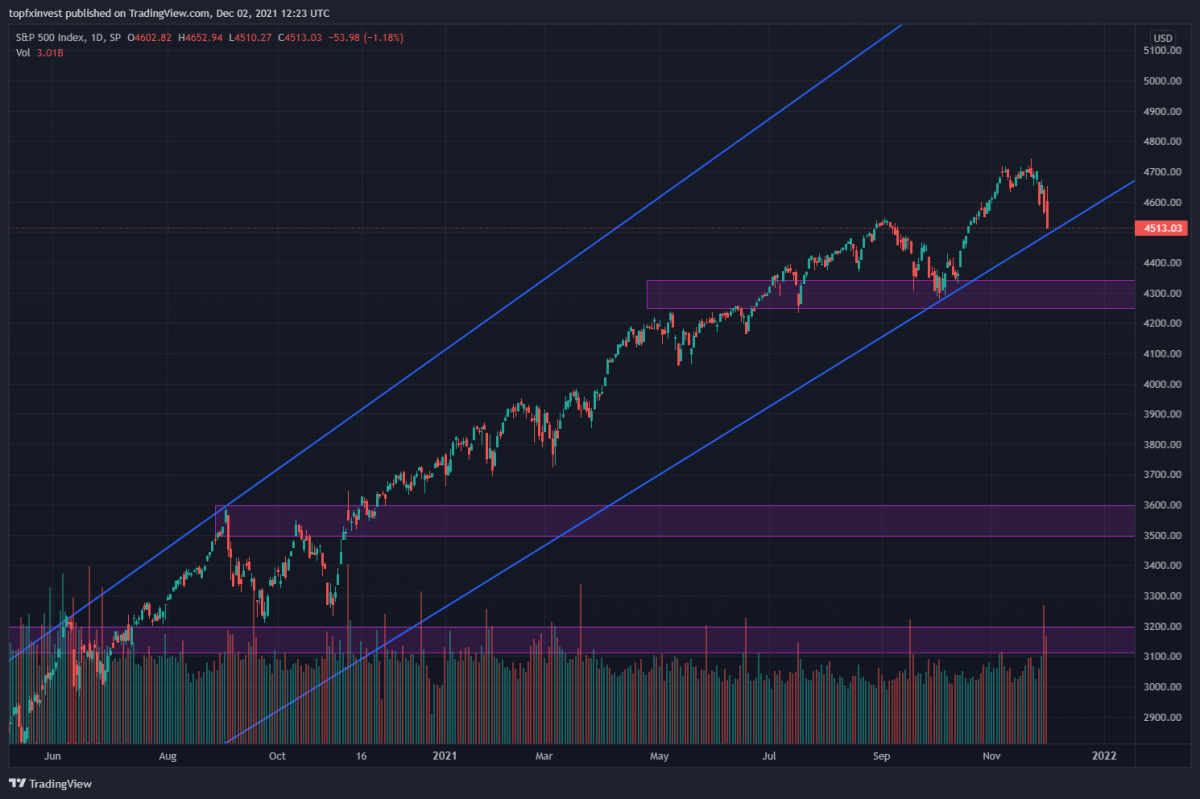

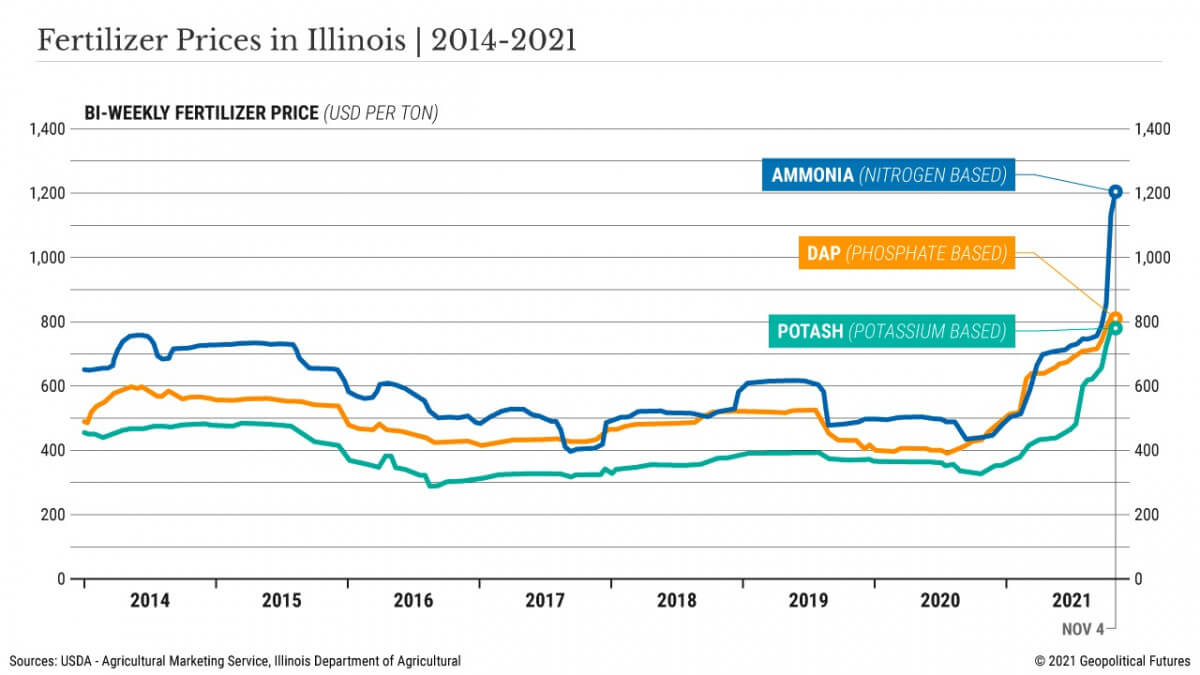

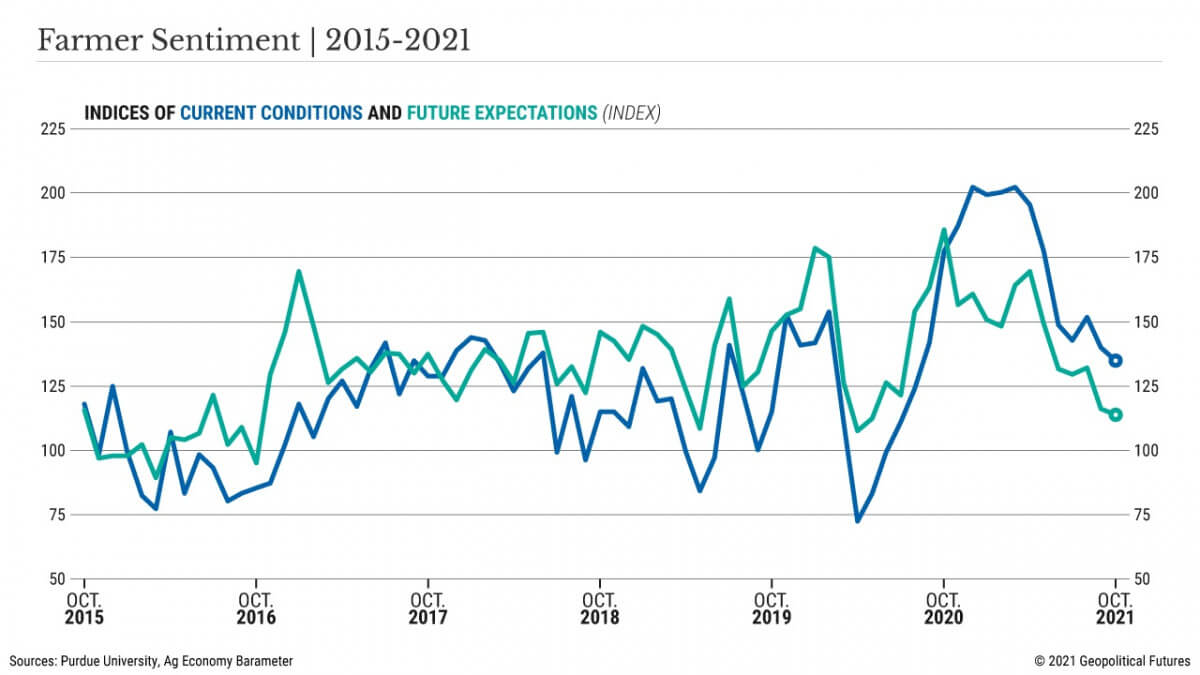

Stocks still have room to move lower from here. We have recommended to buy Agricultural commodities in November and Soybean it's up with 6%.

Stocks still have room to move lower from here. We have recommended to buy Agricultural commodities in November and Soybean it's up with 6%.

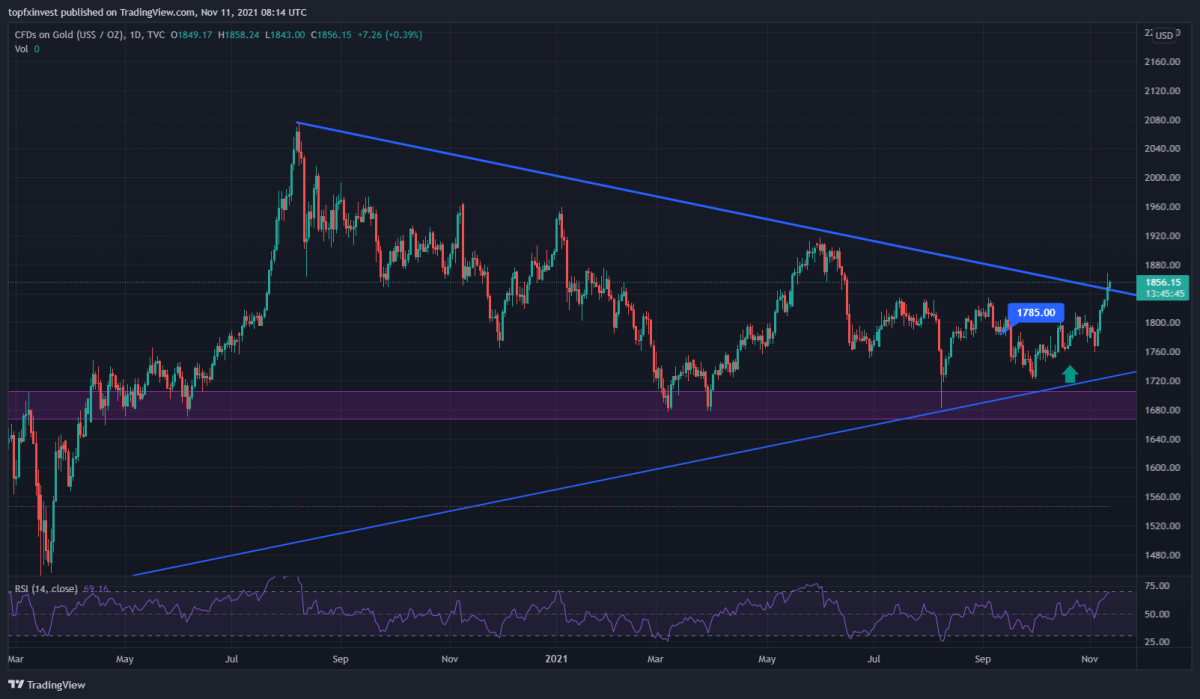

Gold Chart

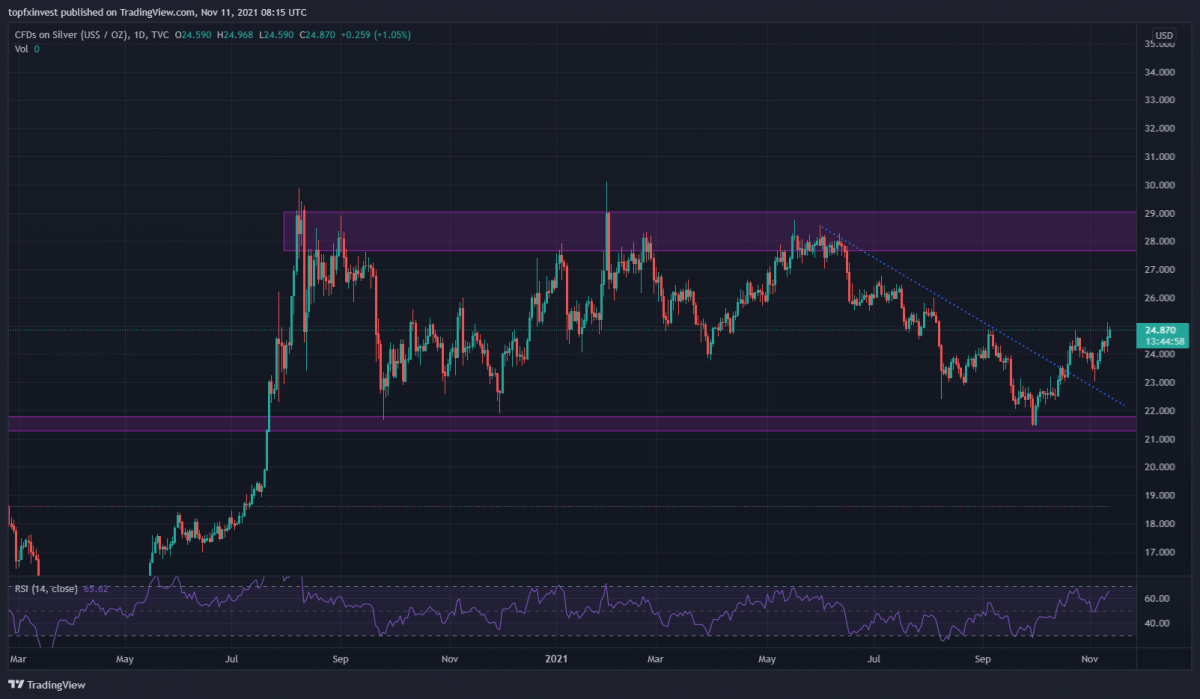

Gold Chart Silver Chart

Silver Chart