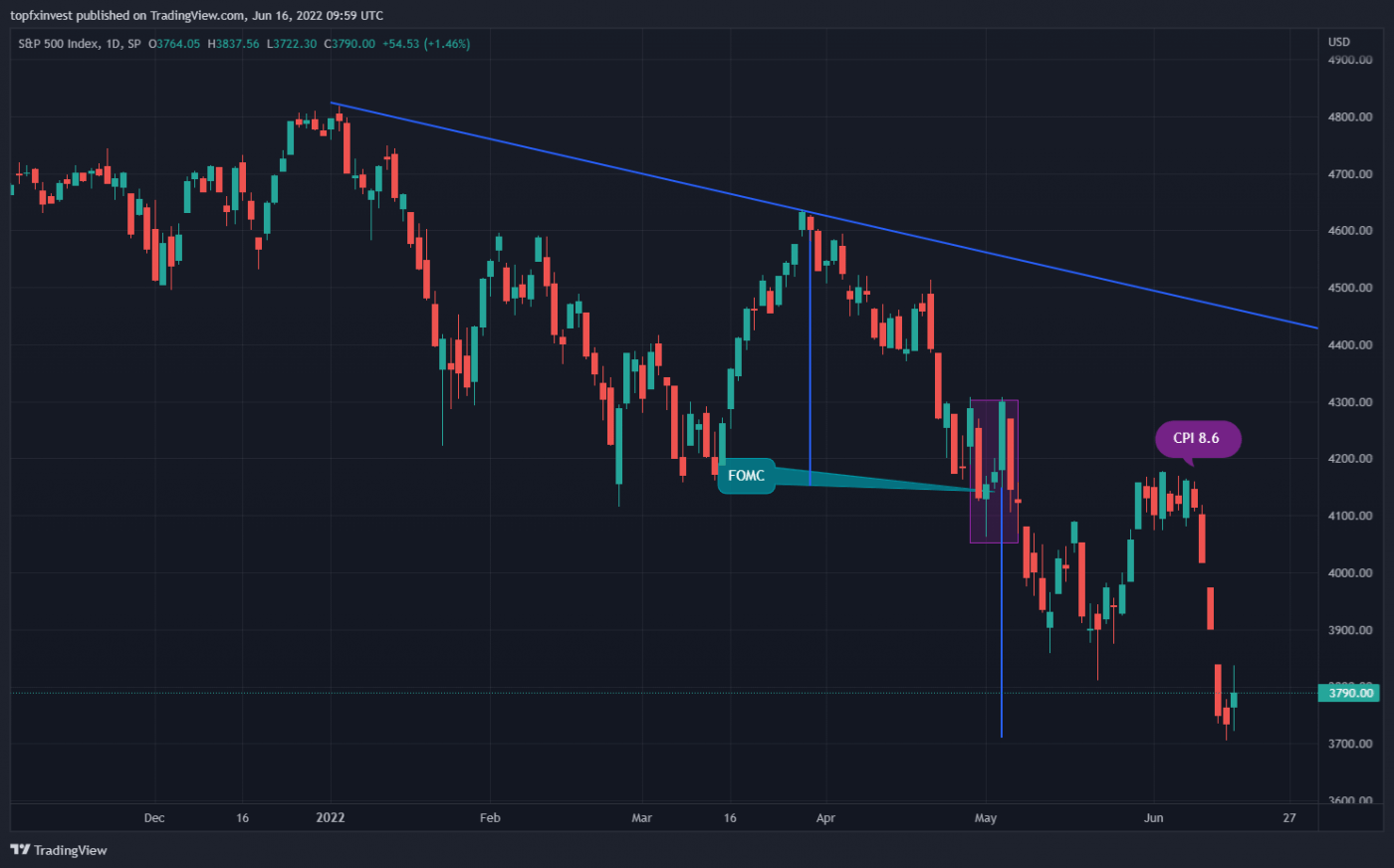

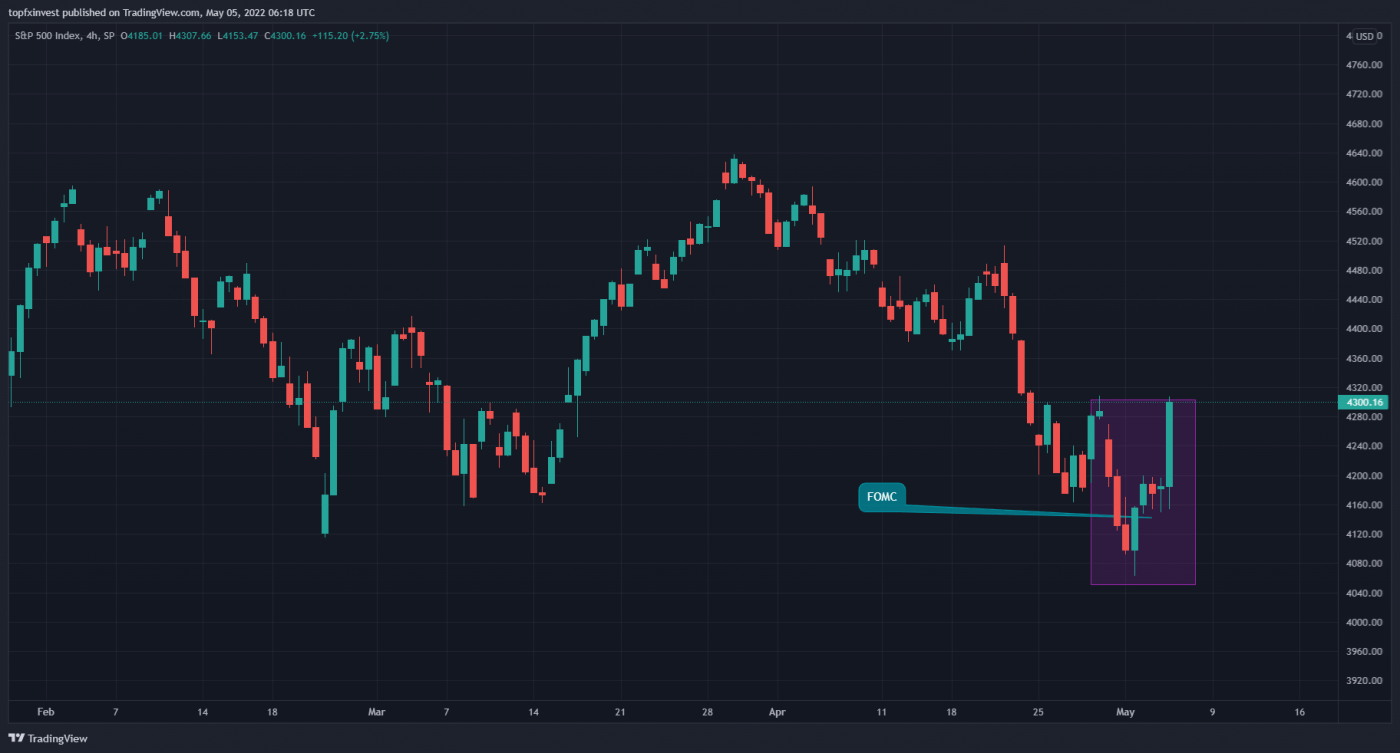

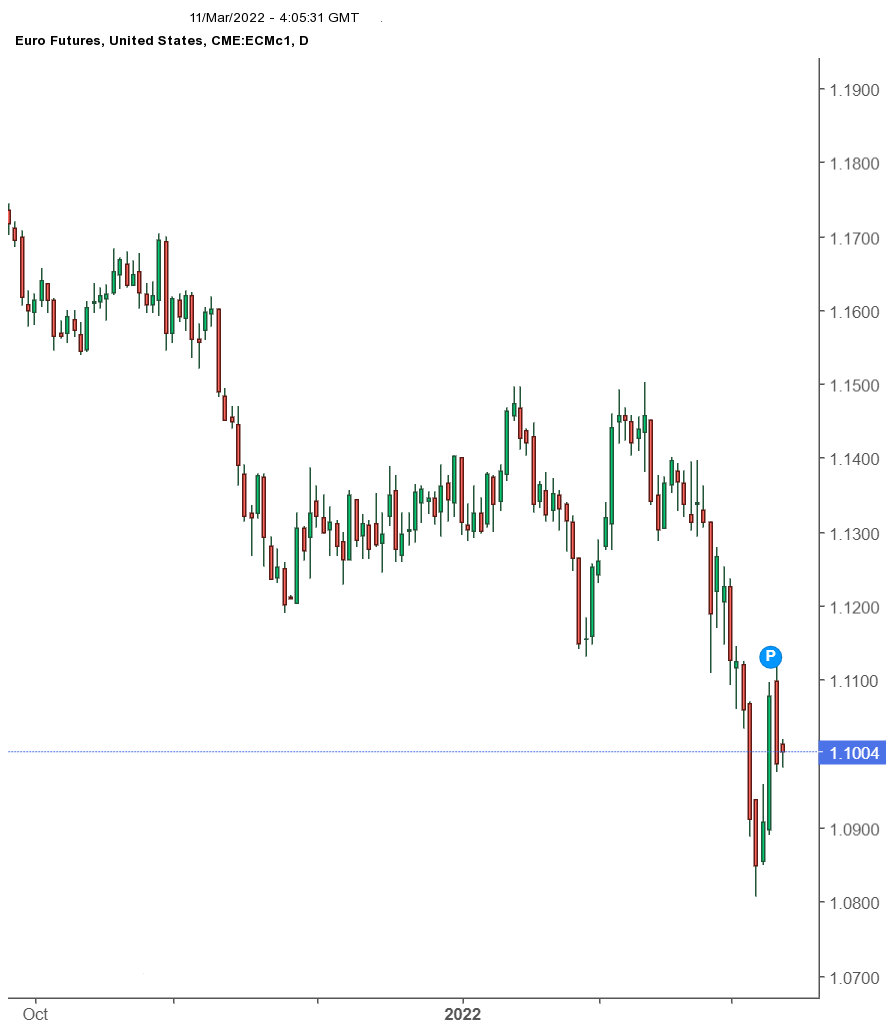

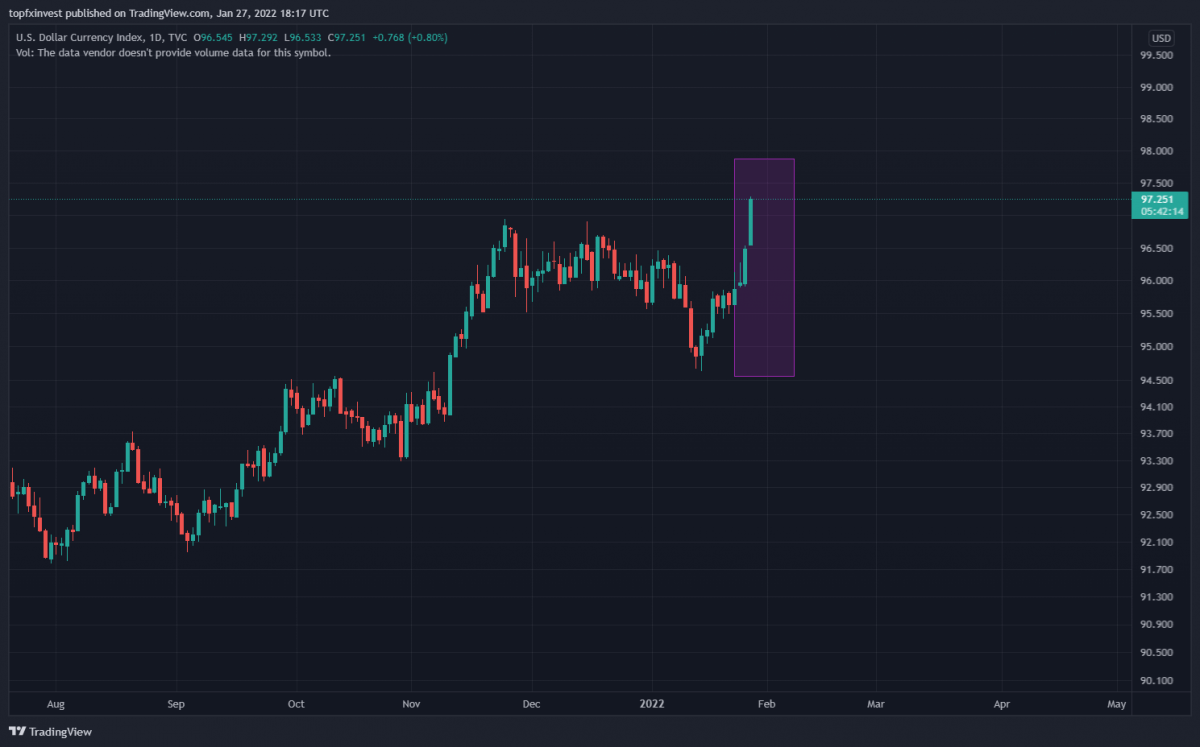

After big rates hike by FED and ECB, investors are hoping that in the following year, central banks will start to normalize rates, therefore Stock market show a bounce back (SPX is near 4.000).

We think it’s a short-lived bounce but a good opportunity for a Risk-Off trade. We see volatility ahead, after rate hikes, because central banks (FED & ECB) are captive to higher inflation. But inflation is caused by production constraints, wars - and rate rises don’t fix these. If inflation was caused by higher demand, than a rate hike, normally, will have a better outcome.

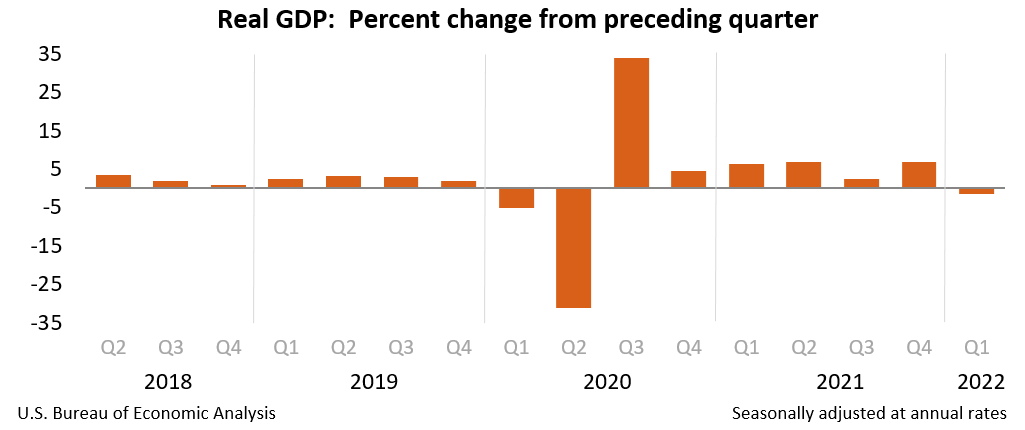

Getting inflation down to the magical number of 2% would mean recession without any doubt and first half year is showing us that GDP is crushed with a 1.6% contraction. Monetary policy is working with delays and the economy is just feeling the effects of one of the most aggressive hiking cycles in history. Stocks rallied 2-4% each of the last four times, the FED hiked interest rates only to fall in the following weeks. Stocks are still expensive and financial results are disappointing, but investors are thinking that this is the bottom, but we cannot embrace this idea. We will face ugly consequences because interest rates were kept too low for too long time (over a decade), central bankers are responsible for the fact that right now we have a bubble on each economy branch.

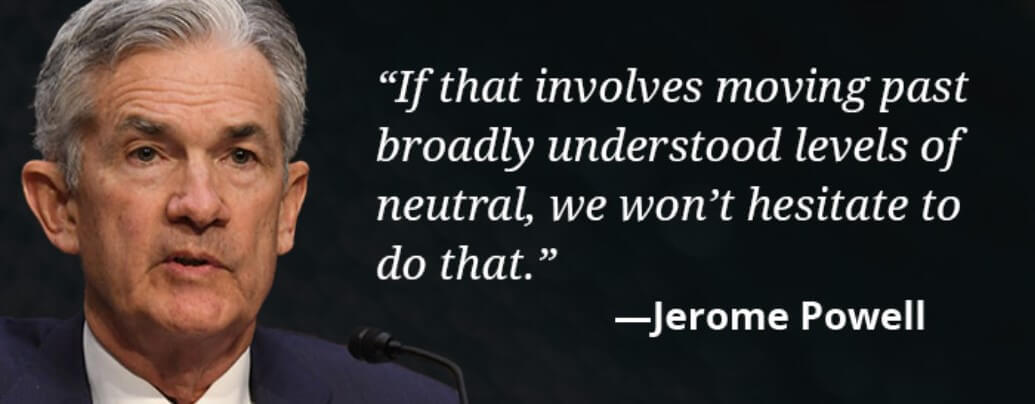

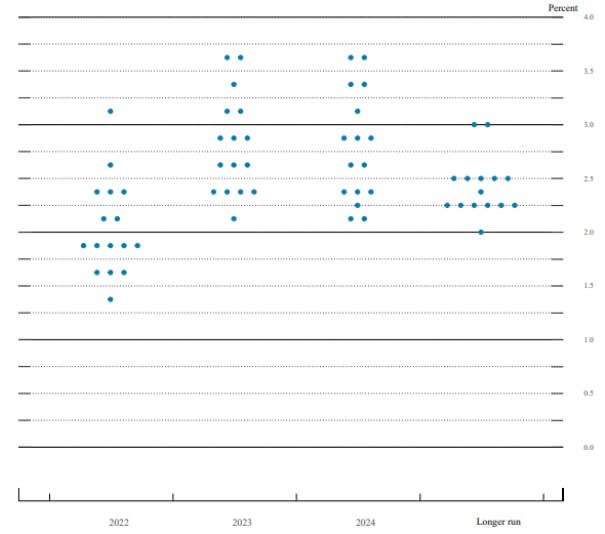

Mr. Powel must act in same way as Volcker did few decades ago in 1979 and hike until inflation will land to normal values. His last speech was a hint to more rate hikes.

Do you believe that we will face a soft landing as Powell said few weeks ago?

We believe that we will face a soft landing in the same way that inflation “was transitory” last year, according to Powell (just read our January 2022 article at: https://topfxinvest.com/blog/thoughts-about-the-2022-bear-market). Mr. Powell also opined that we aren’t in a recession, demonstrating again that the leader of the most powerful central bank in the world is the last person you would want to ask about the economy. Last week, economy suffered its second consecutive quarter of negative real growth and there is little reason to expect the third quarter will be any better.

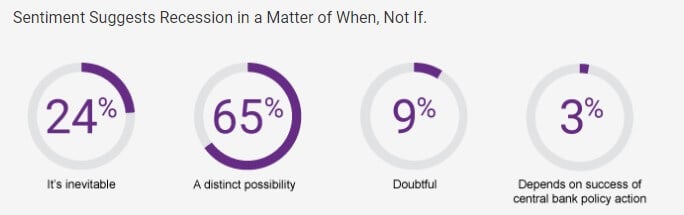

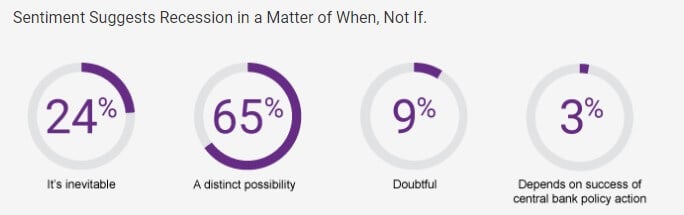

Natixis Investments Managers see higher risks of a recession in the last survey. 64% said that recession is a distinct probability, and 24% said that recession it’s inevitable. Almost six in ten (58%) believe value will continue to outperform growth for at least a few more months, while nearly one-quarter (24%) think value will be on top for a few more years.

"The End of an Era"

Strategists see a world that has changed dramatically in the past six months. After a decade in which the easy money provided by quantitative easing, low rates, and low inflation propelled markets to positive gains in seven out of ten years, the world is moving on. This next normal is marked with greater volatility and greater uncertainty. The big question for most investors may well be: How long will it last?”

If you want to read more about the survey: https://www.im.natixis.com/us/markets/the-end-of-easy-money

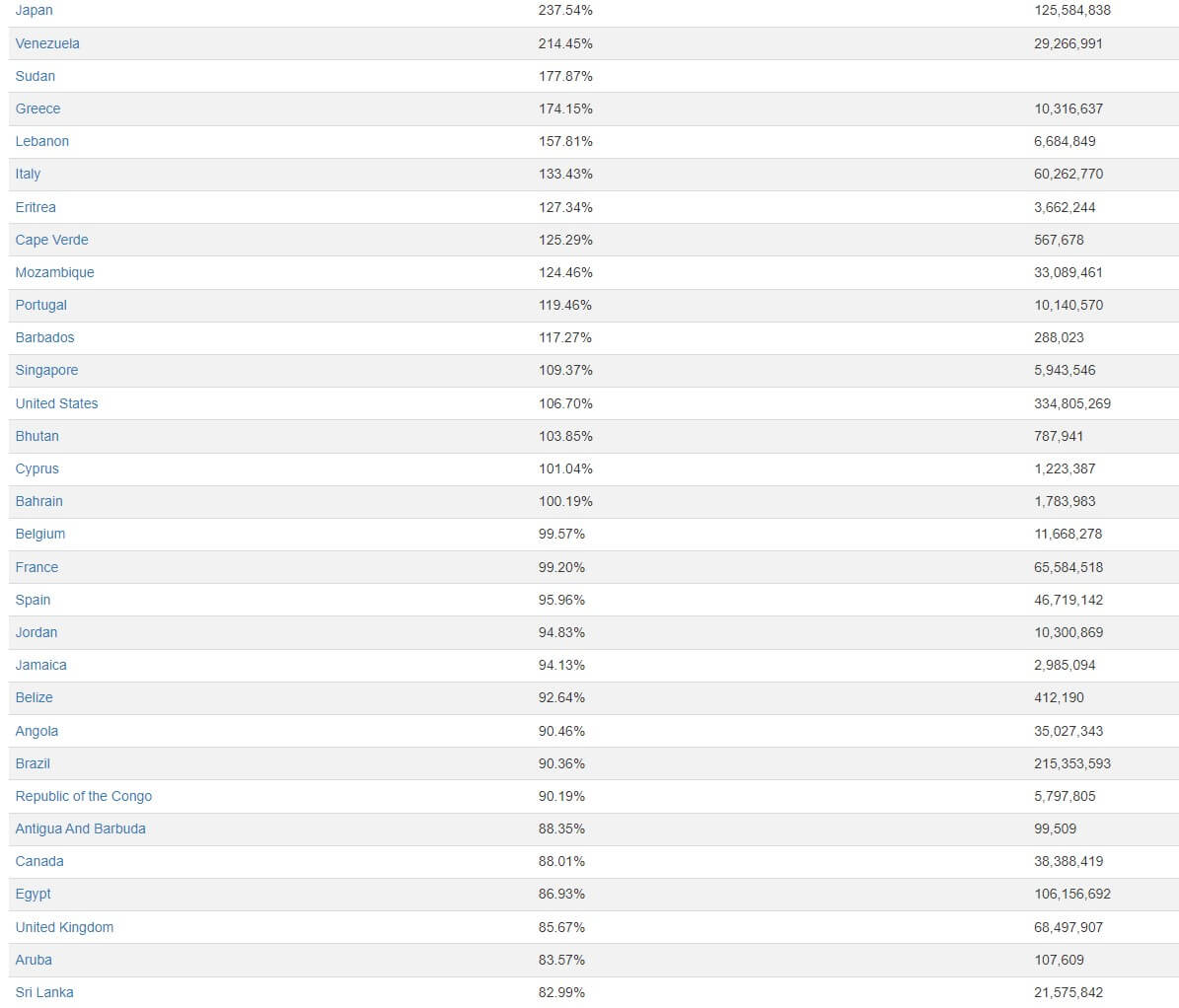

Inflation is a brutal and merciless way of resolving structural debt & imbalances of corrupted governments. We see potentially multiple series of inflation & deflationary cycles within short time frames (six month & two years) that will cause huge volatility.

According to CNBC, inflation is a top problem in US.

Traditional investing style (60% stocks + 40% bonds) it’s not a solution today, because bond’s market is underperforming and stocks are crushed.

How to protect your portfolio during these times?!

We can protect from the financial storm that is arriving by choosing the best stocks & ETFs from few market segments that will perform in difficult times:

Commodities: since prices already dropped off and would be a good hedge against risk-off tone. Symbols: CRN, DCUSAS, WY

Carbon Emission: KRBN, CARB, GRN, NETZ

Consumer Staples Funds: WCOS, XLP, VDC, FSTA, YI 111, INC, IBA, IMB

Real Estate REIT: STOR, O, NNN, SRC, UBA, ID.UN, APR.UN

Precious METALS: ZGLDUS, ZSILUS

Low debt & Cash flow Green Energy Stocks

You must avoid at any price Growth Stocks & Crypto Markets.

View Article with Comments