The ECB has a monetary policy announcement on Thursday and many investors are wondering if euro will fall as the CAD or AUD.ECB was one of the most dovish central bank because of COVID spread and low performance economy.

What we need to watch today:

- Consensus looks for a slowdown in the pace of PEPP purchases during Q4

- A decision on the future of PEPP is not expected to take place at the upcoming meeting

- Economic forecasts are set to see upgrades to 2021 growth and inflation. 2023 inflation is set to remain sub-target

Focus for PEPP will instead fall on the Q4 pace of purchases which is set to be lowered from the current "significantly higher" level of EUR 80bln/month

The press conference will likely see President Lagarde caution that any slowing in the pace of purchases for PEPP will not be regarded as a "taper" as purchases are not on track to reach zero and policymakers will vow to maintain favorable financing conditions.

Policymakers were not expecting to make a decision on the future of PEPP bond purchases in September given the persistent uncertainty posed by the pandemic but a decision in October or December was seen as more likely.

Chart below you can see nomura forecast on PEPP

What about Rates

Rates according to Lagarde will “remain at their present or lower levels until it sees inflation reaching two per cent well ahead of the end of its projection horizon and durably for the rest of the projection horizon, and it judges that realised progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilising at two per cent over the medium term."

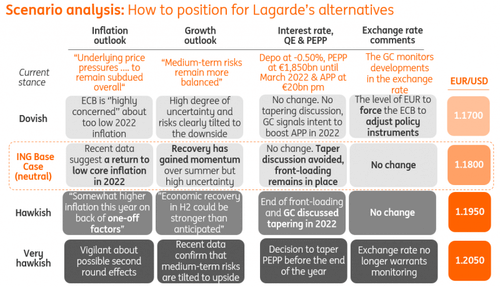

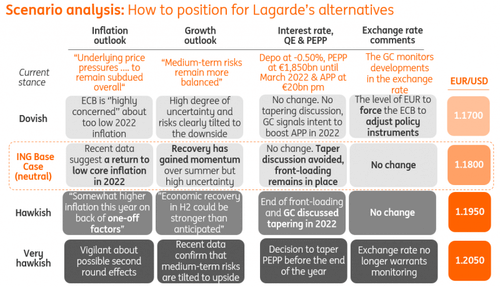

Ing case scenario on ECB Forecast

View Article with Comments