We have taken a Gold & Silver Position two weeks ago, at 1.710, and respectively 22.4 because we consider that Gold & Silver are the best bet against inflation, to add it at a portfolio.

We placed our funds via ZSILUS & ZGLDUS from Switzerland (Cantobank) considering primarily the safety of the funds, but in the TIPRANKS platform we added AAAU ETF and SLV ETF, as the aforementioned funds were not available.

Why do we like Silver & Gold in the long run, from a Fundamental point of view?

- Gold & Silver are growing with fast peace because of the inflation pressure, CPI m/m numbers are much higher than expected: 9% versus 6%.

- More than 50% of Silver’s demand originates from the industrial use. Also, being a malleable metal, Silver is just as good as Gold for jewelry making. It is also a good conductor of electricity, and it is used extensively in the manufacture of electronic components.

- The transition to clean energy is expected to drive physical demand for Silver in the coming years, particularly for using it for connections in electric vehicles and for components in solar panels.

- Growing of the Fifth Generation (5G) Telecom Networks will also fuel the demand for Silver in the next years.

- Mining companies are worst performing in the last decade because of poor investments in this area.

Why don’t we like Silver & Gold in the long run, from a Fundamental point of view?

- Monthly manufacturing PMI, or Purchasing Managers’ Index figures from around the world are losing the momentum. We have some decline in summer (55.6 to 54) but it's still above 50, that means we are still in the expansion cycle. If trend will continue, it will drag lower especially on Silver, but Gold also. JP Morgan’s global PMI reading steadied at 54.1 in September, and we see some flat readings.

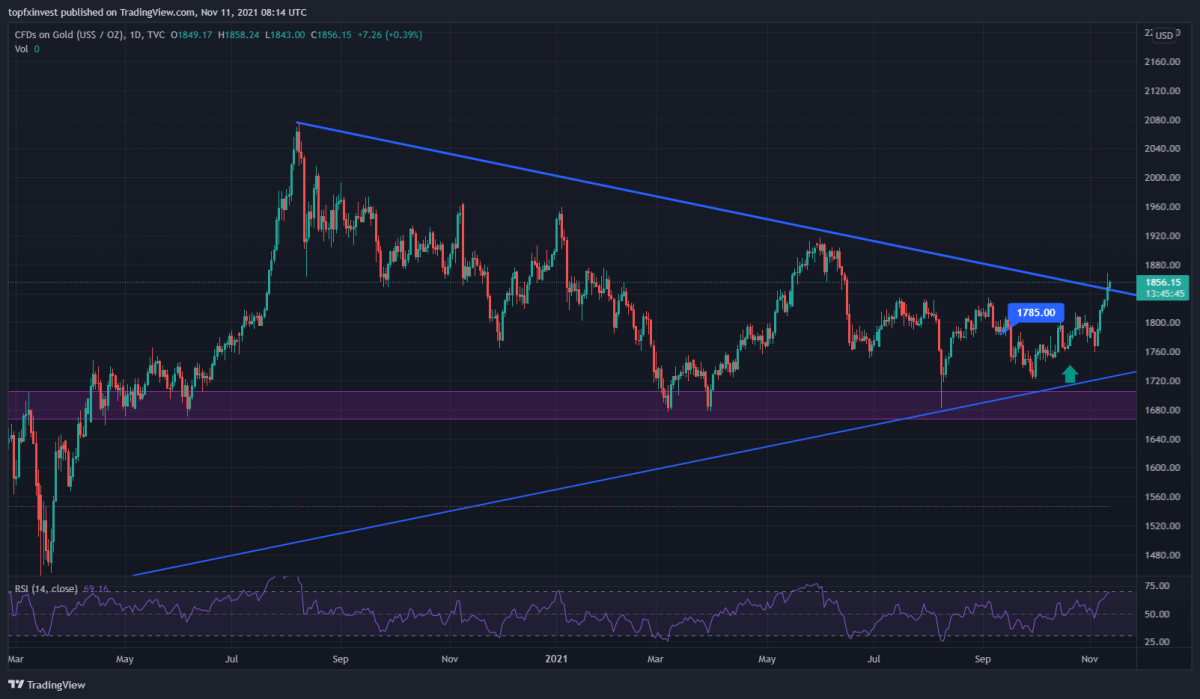

- Speculation since June, that the Federal Reserve will roll back its generous monthly stimulus of up to $120 billion that it has provided to the US economy since March 2020. That speculation weighed on Gold and Silver prices in the earlier months. On the stimulus end, the FED announced last week it would conclude its asset purchases in mid 2022 by tapering $15 billion each month from the program over the next eight months. FED Chair Jerome Powell also assured markets that the central bank will be “patient” in executing the first post-pandemic rate hike, which will likely take place at the end of next year. Possibility of a rate hike is dragging lower Gold, but in the long run Gold will continue to grow because of the huge amount of dollars printing in the pandemic outbreak. We have recommended buying Gold from 1.32 two years ago. Gold will enter in the second wave of growth if it breaks the Flag Formation next months.

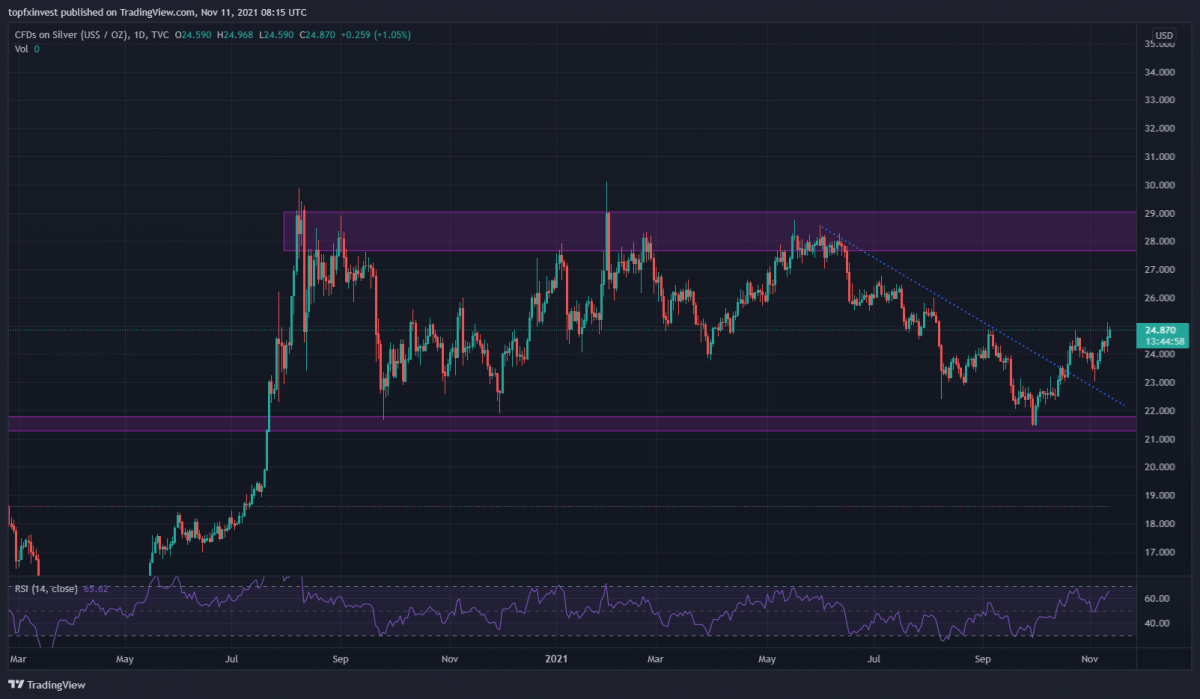

From the Technical point of view, Gold & Silver is breaking resistance this week and it's still a good moment to add them to the portfolio, for the next years. We consider that Gold will reach the 2500$-3000$ area. Gold is breaking from a Flag Formation and Silver is bouncing from Range area. Please consider the charts below:

Gold Chart

Gold Chart

Silver Chart

Silver Chart