Yesterday markets were down with over 2% because disappointing Earning Results from banks like JPMorgan & Citi Bank. We are still waiting results of other big banks like Goldman Sachs, Bank of America. Morgan Stanley, to see if the lower trend will continue this week. The key driver to the current action in the stock market remains the spike in bond yields and announced Increased Rates. This Year stocks will be dealing with the highest inflation rate since the late 1970s, excessively high valuations, and an aggressive policy change by the Fed.

2022 it's a year of challenge for stocks because we have to deal with:

- Lower Profit margin

- To high valuations

- Less liquidity in the economy

- Higher inflation

- Weaker economic growth

- Weak consumer confidence due to inflation

- Flattening yield curve

- Lower earnings growth

- Weaker economic data than 2021

- Tighter monetary policy

- Reduced consumption

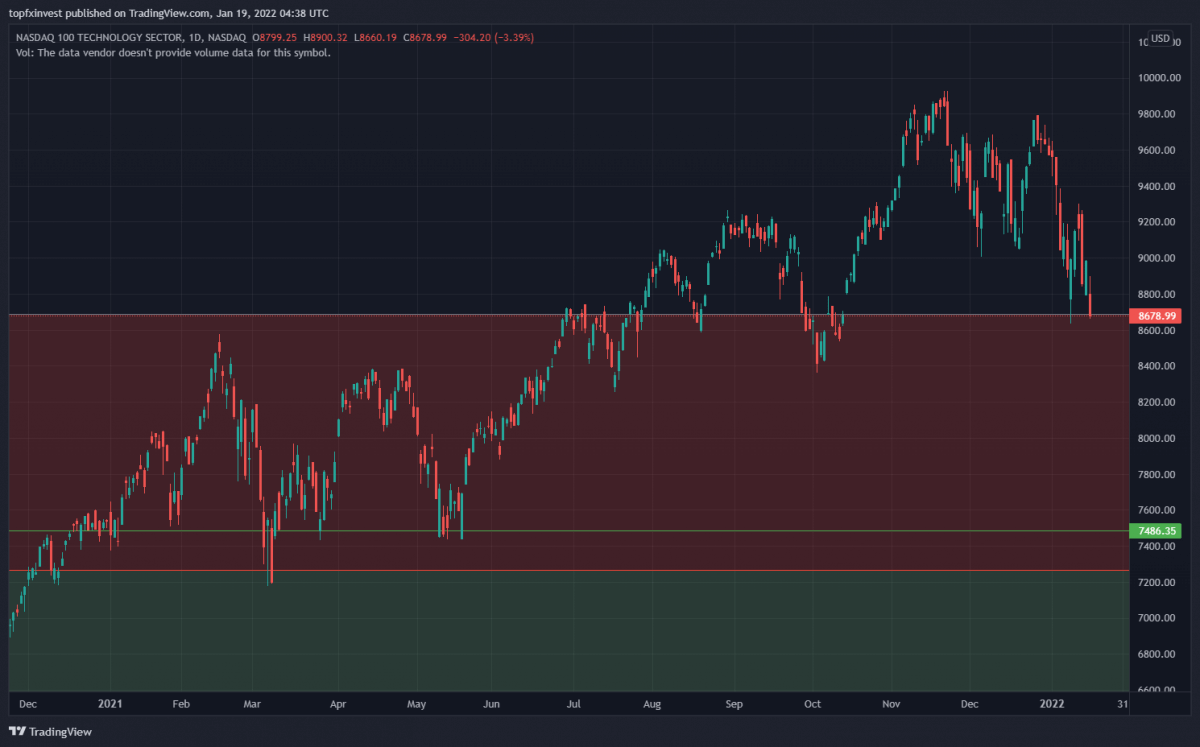

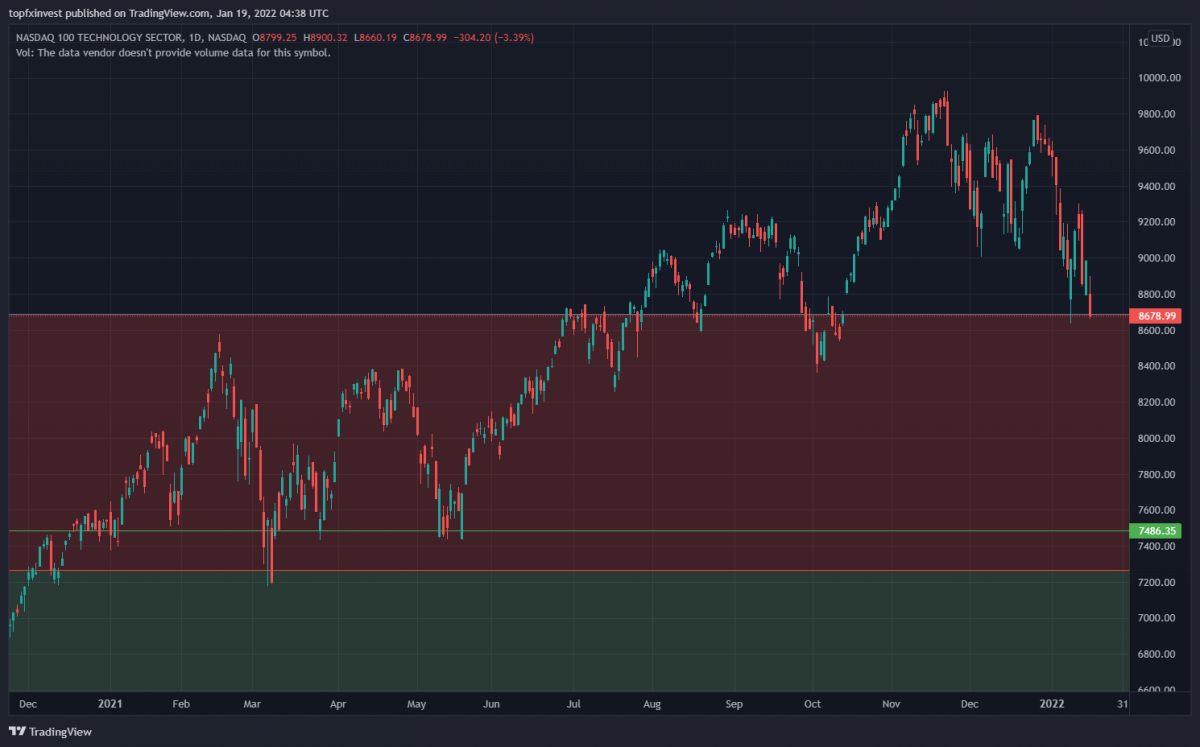

Technically, Stocks broke below yesterday Trend Support Line with momentum and also Vix is UP. Tech Stock was affected badly losing over 3,3%

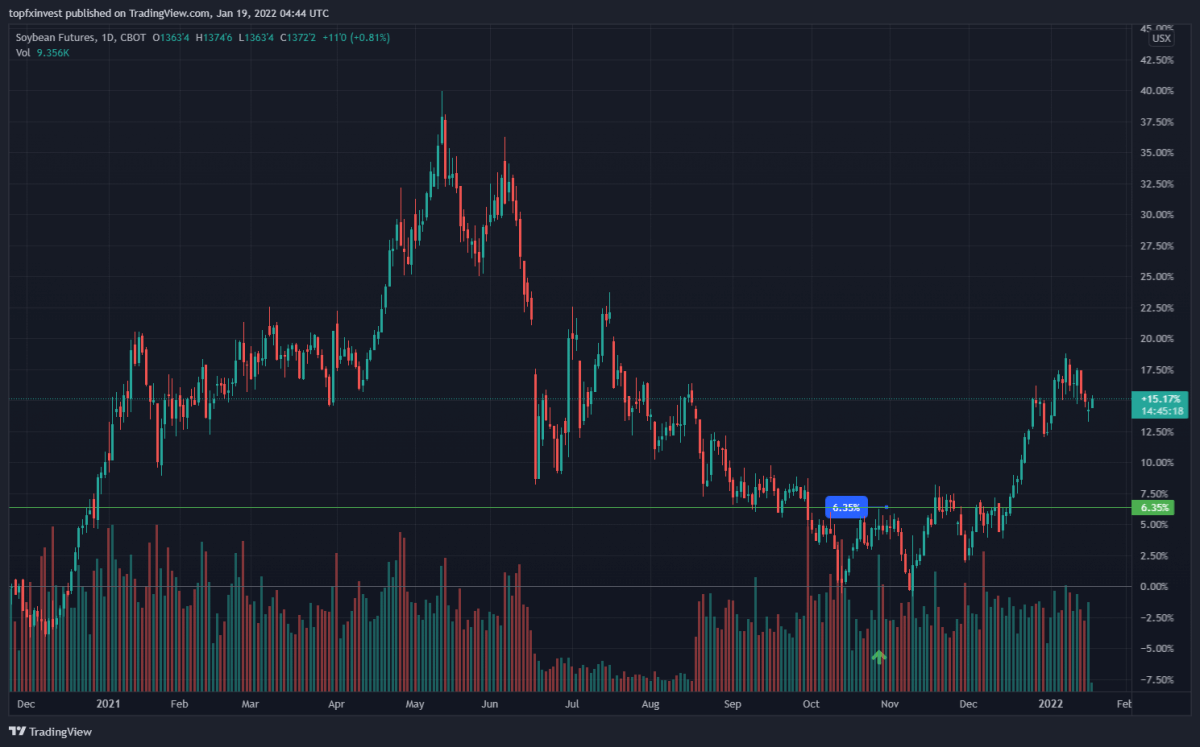

Stocks still have room to move lower from here. We have recommended to buy Agricultural commodities in November and Soybean it's up with 6%.

Stocks still have room to move lower from here. We have recommended to buy Agricultural commodities in November and Soybean it's up with 6%.