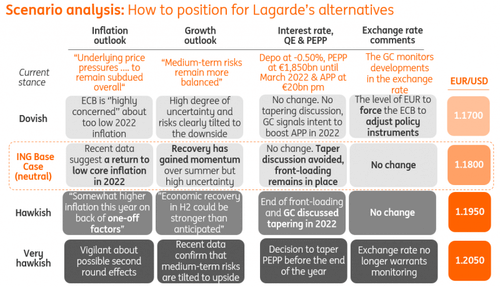

The news about higher prices of food abounds in online stream media. Agricultural prices will go higher in 2022 and will have a significant impact on CPI. The main reason of higher agricultural prices in 2022 are Shortage of Fertilizers. Fertilizers prices have grown up this year because of the higher prices of gas and transportation disruptions.

Crops benefit more from fertilizer treatments in the early phases of the planting season. Delayed or missed application during the cycle will almost certainly result in lower yields, which tightens the food supply and drives the prices up.

Transportation disruptions because of Covid19 outbreak has affected also delivery of parts for agricultural machinery. Many farmers acquired some agricultural machinery components from over 1000 km distance. Farmers from Ukraine – the main corn producer in Europe – bought agricultural machinery parts from Austria or Germany with considerable time delays (over three months). Many farmers are purchasing parts in advance for safekeeping.

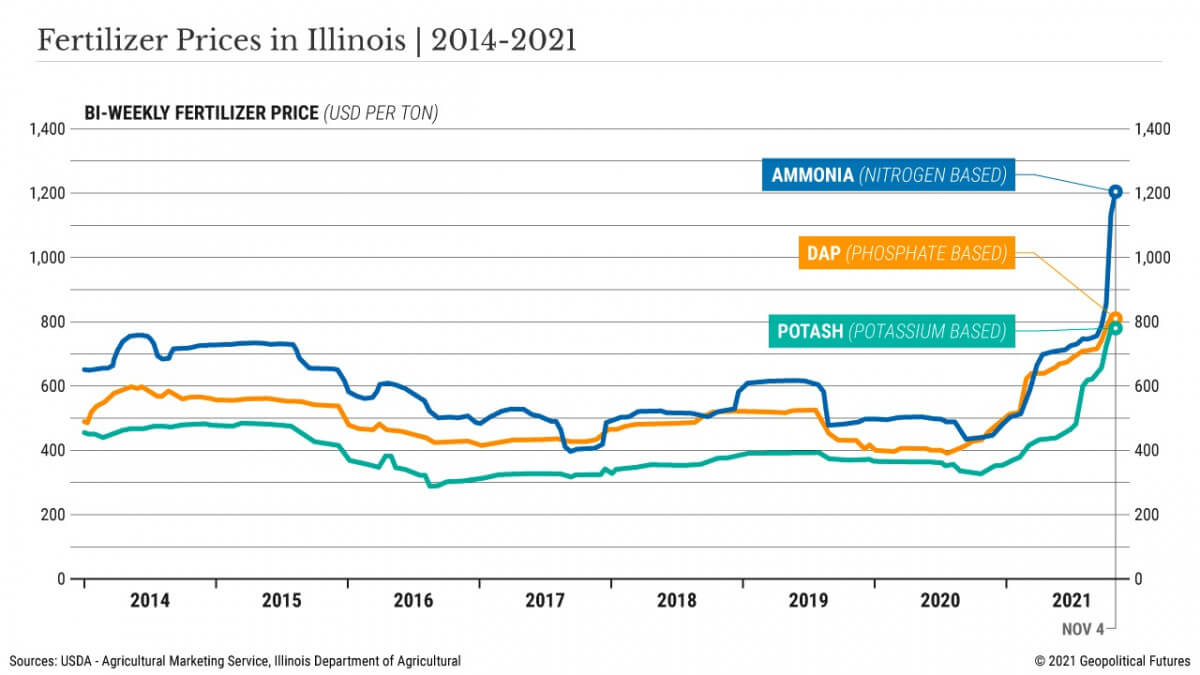

U.S. farmers appear pessimistic. Agricultural producer sentiment has started to decline in recent months. The sentiment for future conditions is now nearly as low as it was in the peak economic closure of the 2020 pandemic. Farmers have expressed concern over high input costs – i.e., fertilizer prices – weakening their operating margins.

We play this trade idea to buy Agricultural Funds like:

- Invesco DB Agriculture Fund (DBA)

- Elements Linked to the Rogers International Commodity Index — Agriculture Total Return ETN (RJA)

- Teucrium Corn Fund (CORN)

For European traders, we have limited opportunities via Lyxor Commodities Refinitiv / CoreCommodity CRB EX-Energy TR UCITS ETF – Acc (CRN). Lyxor is a fund with over 56% exposure on agricultural products, and also precious metals (11.78%) and commodities stocks (11.35%).